eXoZymes Q3 Investor Call: $EXOZ as a once-in-a-lifetime opportunity

Seven key takeaways from the Q3 Investor Call that have made me even more bullish on $EXOZ.

eXoZymes’ recent Q3 investor call was, in my view, a genuine inflection point for the company. For the first time, management laid out a clear, commercially driven roadmap that connects near-term revenues, potential multi-billion-dollar exits and a disciplined capital and operating strategy designed to protect and compound shareholder value.

Those who follow Slack Capital are already aware of my extremely bullish stance on eXoZymes, and the Q3 call held last Thursday has only reinforced that conviction. The risk-reward for what I see as a genuinely rare, once-in-a-lifetime biotech investment opportunity has somehow become even more compelling.

For those new to eXoZymes, I’d strongly recommend understanding the underlying technology and business model before diving into the details of this update. My two reports on the company serve as a starting point:

For investors initiating a position or actively following the story, I also invite you to join the DEDICATED EXOZYMES CHANNEL.

Below are the seven key takeaways from the call.

1 – DUAL-MARKET ASSET DESIGN TO MAXIMISE VALUE AND REDUCE RISK

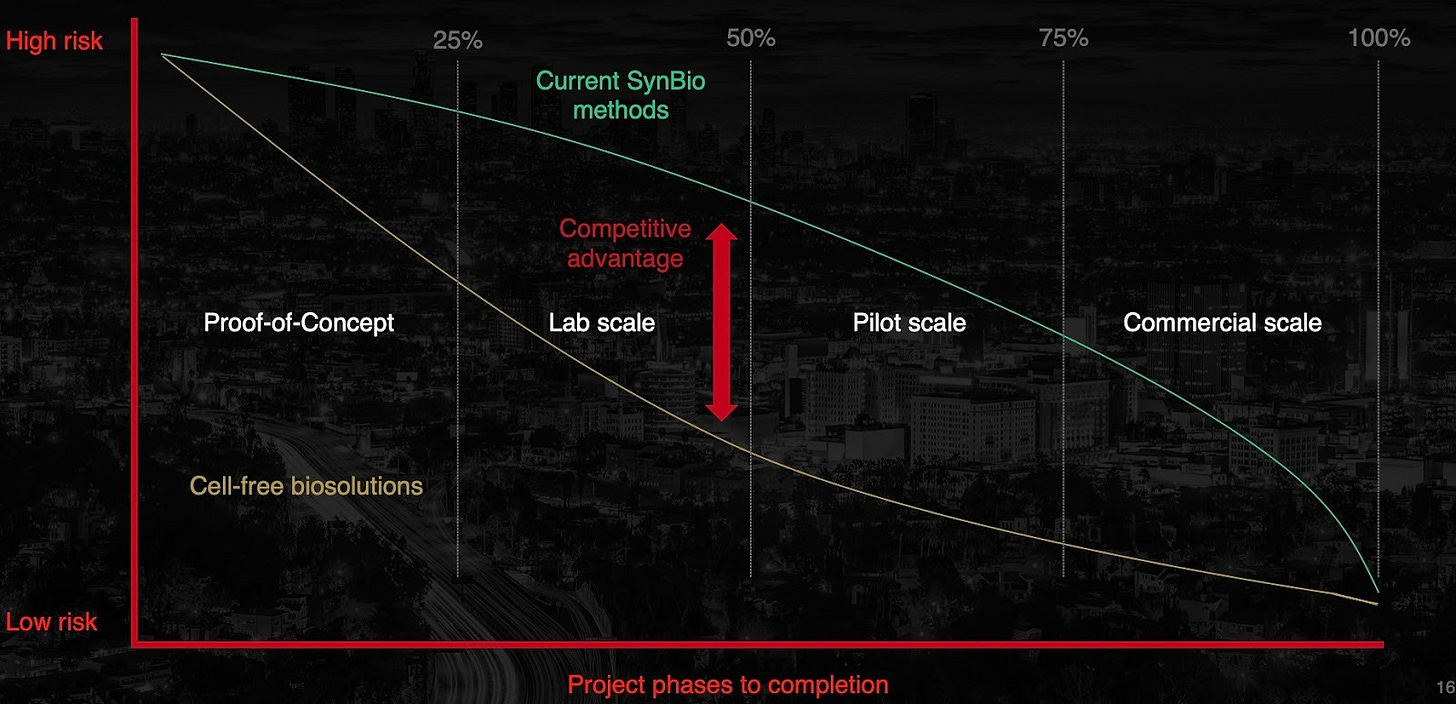

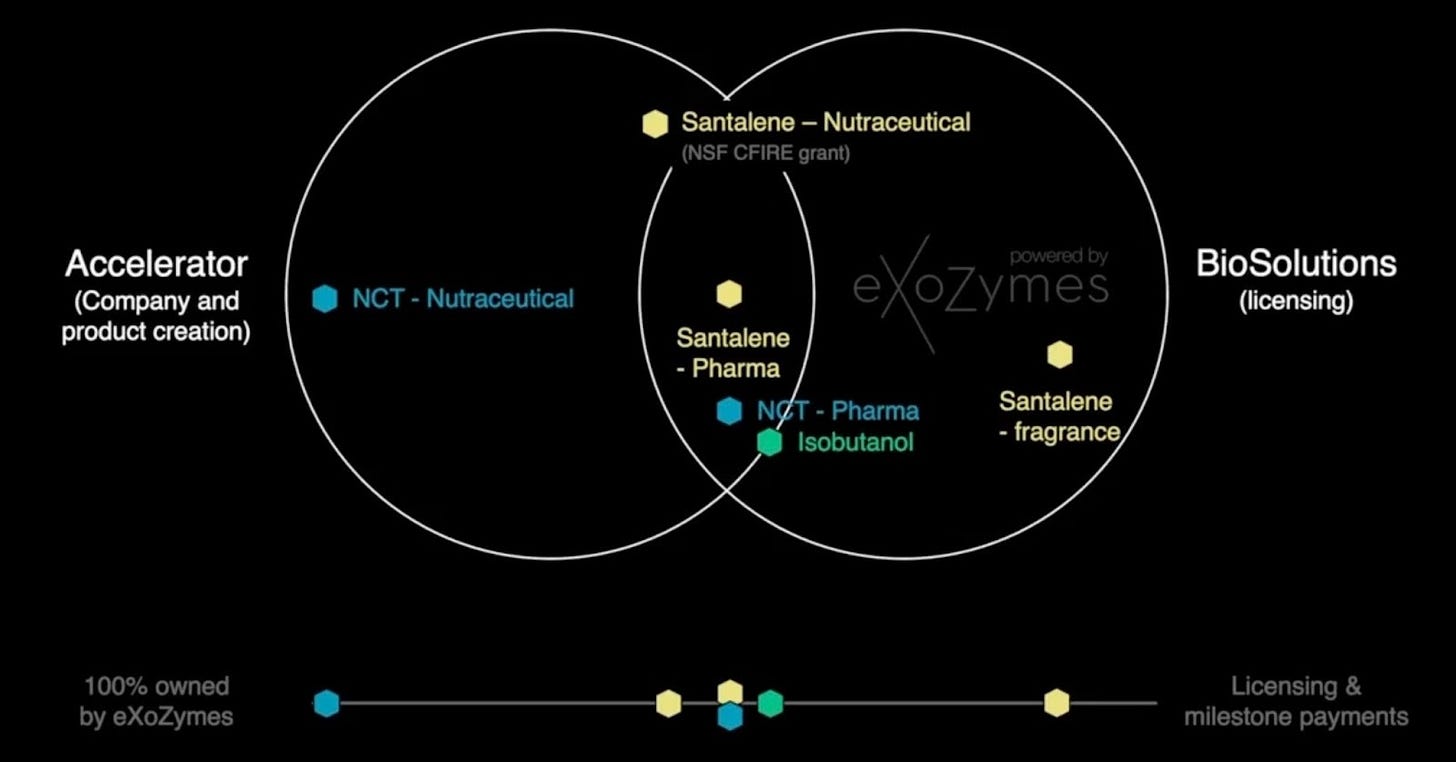

Each of eXoZymes’ extraordinary business cases are intentionally designed to target at least two high-value markets, maximising the value from the same underlying R&D while creating multiple monetisation pathways.

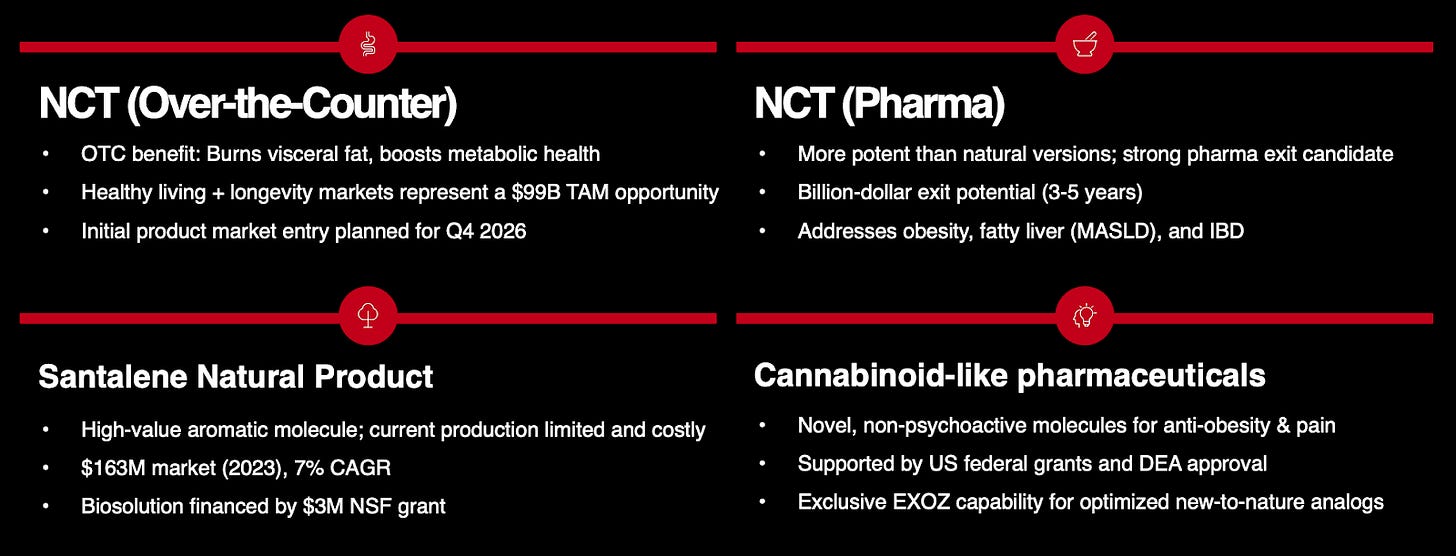

The most compelling program, N-trans-caffeoyltyramine (NCT), is being advanced for both the nutraceutical and pharmaceutical markets. On the nutraceutical side, eXoZymes is targeting a near-term commercialisation opportunity by positioning NCT as an over-the-counter (OTC) supplement for metabolic, longevity, and gut health support, with first revenues projected from Q1 2027 onwards. In parallel, the NCT pharmaceutical analog program will follow a longer development and regulatory journey. If key preclinical and clinical milestones are achieved over the next 3-5 years, this program could support a potential multi-billion-dollar exit. Together, these two distinct target markets dramatically improve NCT’s overall risk-return profile.

On the investor call, management stated that they plan to apply this same selective approach to future extraordinary business cases. Each new asset will be identified and designed to enable the fundamental R&D efforts to open more than one market segment. This maximises the value created from every R&D dollar spent, establishing an inherently diversified product portfolio and lowering each program’s overall development risk.

The dual-market approach also provides various strategic deal structures depending on the market opportunity, including spin-out vehicles such as NCTx for the NCT nutraceuticals opportunity or structured joint ventures. This allows eXoZymes to selectively partner with organisations that have distinctly complementary skill sets for that compound’s journey to commercial readiness.

2 - DISCIPLINED FOCUS TO BUILD A REPEATABLE COMMERCIALISATION PLAYBOOK

While eXoZymes’ platform has the potential to disrupt hundreds of chemical manufacturing processes, the Q3 investor call reinforced management’s disciplined, capital-efficient near-term strategy. The company is concentrating its efforts on its three core extraordinary business cases: NCT, non-intoxicating cannabinoids and Santalene.

Following the Pareto Principle approach, which focuses on the 20% that can deliver 80% of the value, ensures that eXoZymes directs resources into the highest-leverage opportunities and avoids diluting capital, management attention and technical focus across lower-priority projects.

By narrowing its focus, eXoZymes is also building the company’s internal playbook. Each extraordinary business case provides real-world, practical lessons in scale-up, manufacturing pathway development, regulatory planning, IP strategy, partnership negotiation and techno-economic model design to name a few key areas. Together, these learnings create a repeatable commercialisation framework for future development programs, ensuring they can be advanced faster, at lower cost and with higher probability of commercial success.

With key milestones and potential partnership announcements expected over the coming months, 2026 is shaping up as the year in which the foundations for future commercial success are laid. Once the three core extraordinary business cases have progressed through this critical development phase, 2027 and beyond should see a rapid rollout of additional programs and a meaningful expansion of the company’s value as the broader pipeline begins to commercialise.

3 - NCTX ON TRACK FOR Q1 2027 REVENUE, TARGETING US$200B+ WELLNESS MARKET

During the call, management provided a detailed update on NCTx, the purpose-built vehicle that holds the licence for eXoZymes’ NCT OTC applications.

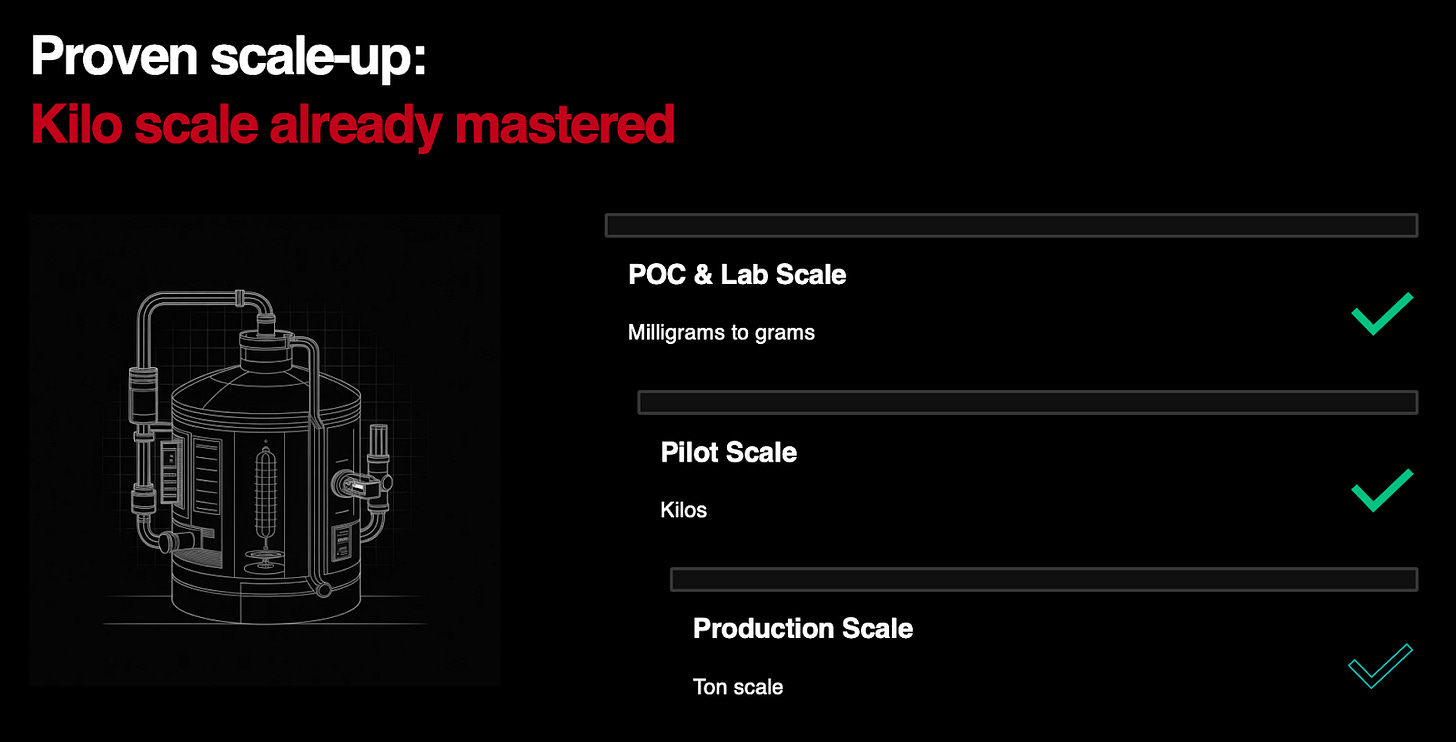

eXoZymes has developed a biomanufacturing solution for NCT that overcomes the fundamental supply constraint of the highly valuable compound. NCT occurs only in trace amounts (0.014%) in hemp seeds, with prior attempts to synthesise the compound failing despite years of effort and millions of dollars invested by other companies. In just five months, eXoZymes had demonstrated production of 4 grams of NCT at 99% purity and 96% yield. To obtain the same amount of the compound from natural extraction would require approximately 25 kilograms of hemp seeds, or around 1,600 hemp plants.

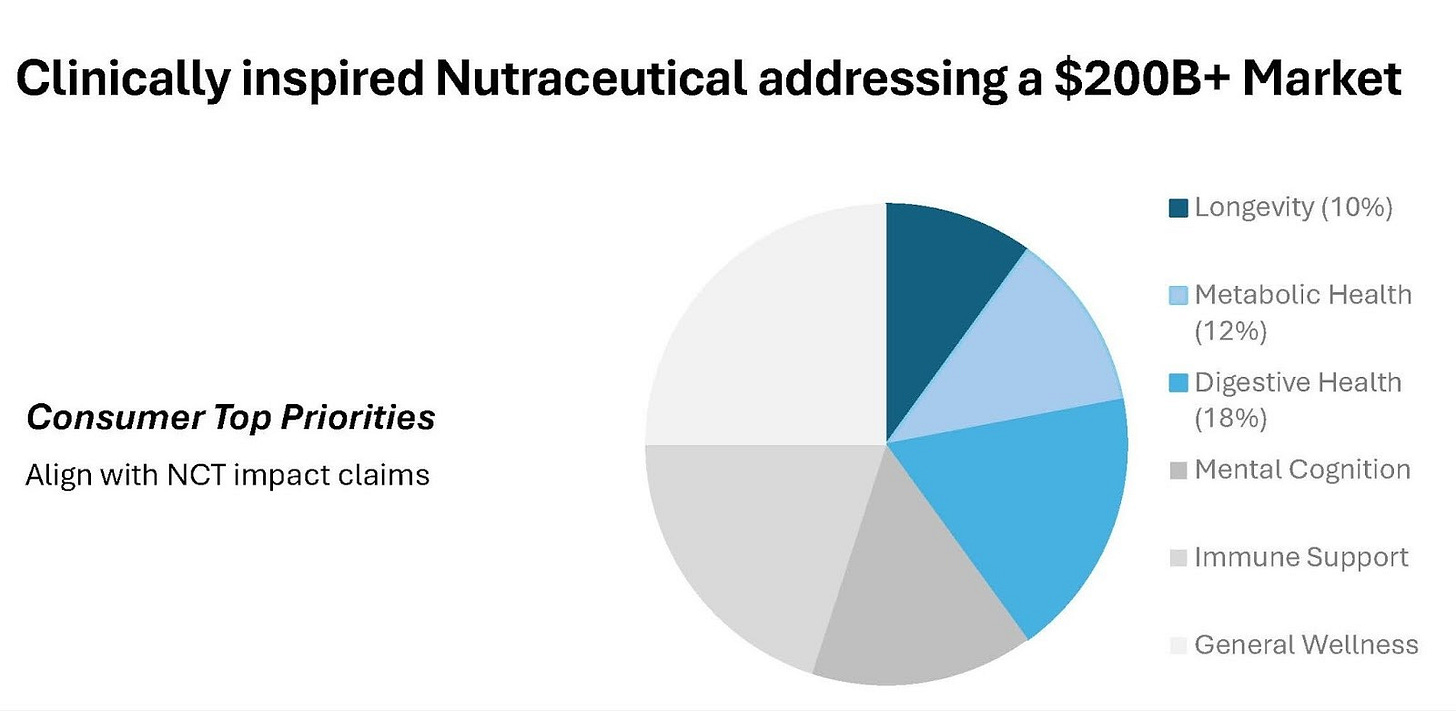

Scientific literature indicates that NCT has genuine efficacy across the three pillars driving current wellness market growth, including longevity support (mitochondrial function), metabolic health (fat burning and energy production) and digestive health (gut barrier integrity). These three pillars together represent a substantial, fast-growing global wellness market worth over US$200+ billion. This positions NCT directly within the highest-demand segments of consumer health.

Given the size of the NCT OTC opportunity, eXoZymes has already attracted significant interest from more than 42 parties spanning CMO providers, formulation companies and global supplement brands.

On the Investor Call, eXoZymes confirmed that its 100x NCT OTC scaling campaign is on track, with results expected in December. This will be a major de-risking milestone, enabling eXoZymes to start sending product samples to global supplement formulation partners.

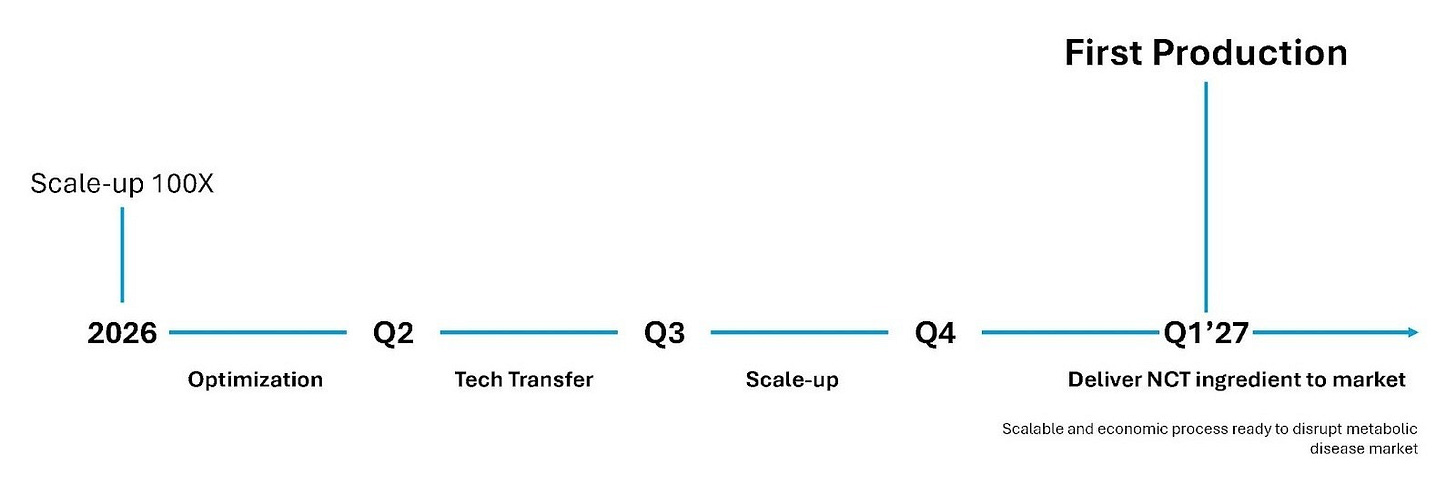

Management also clarified why they are not rushing to sign partnership deals at this current stage. They see far greater value in advancing NCTx’s technical and commercial readiness before bringing partners in. Damien Perriman, eXoZymes’ CCO, outlined a 12-month development plan for NCTx during 2026, including optimisation of the synthesis module in Q1, tech transfer to a contract manufacturing organisation (CMO) in Q2, and initiation of commercial-scale production in Q3. Reaching these milestones should significantly strengthen NCTx’s negotiating leverage and valuation.

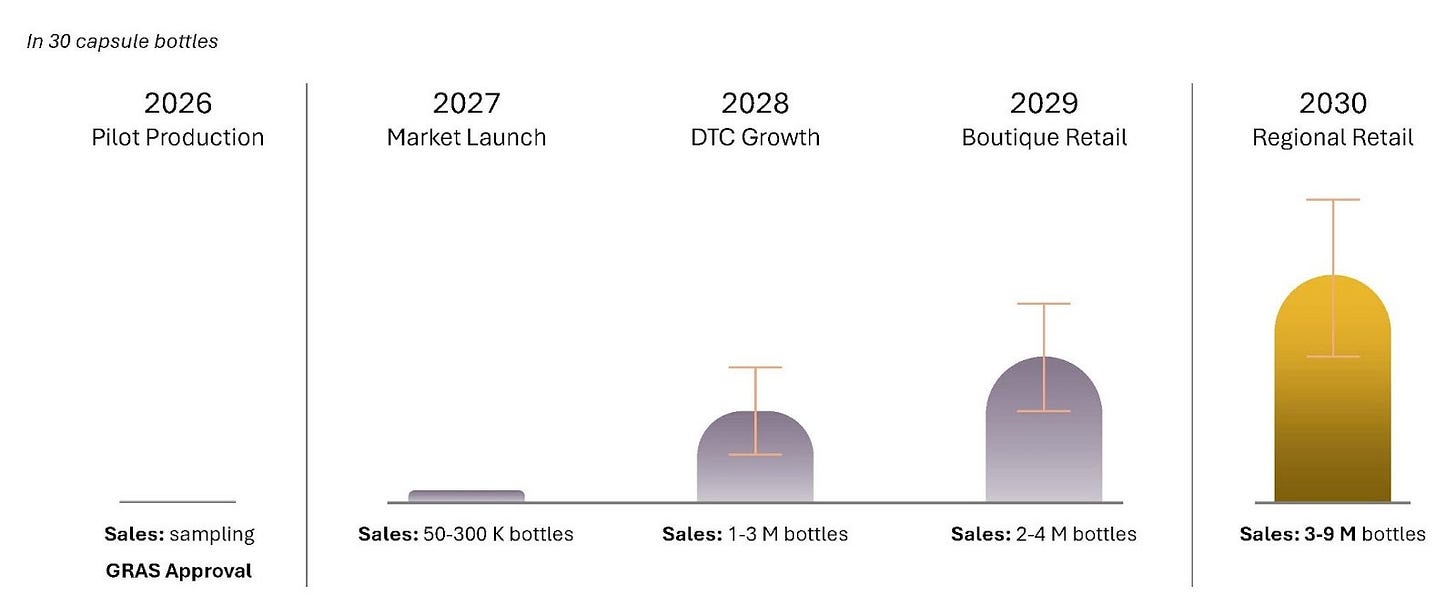

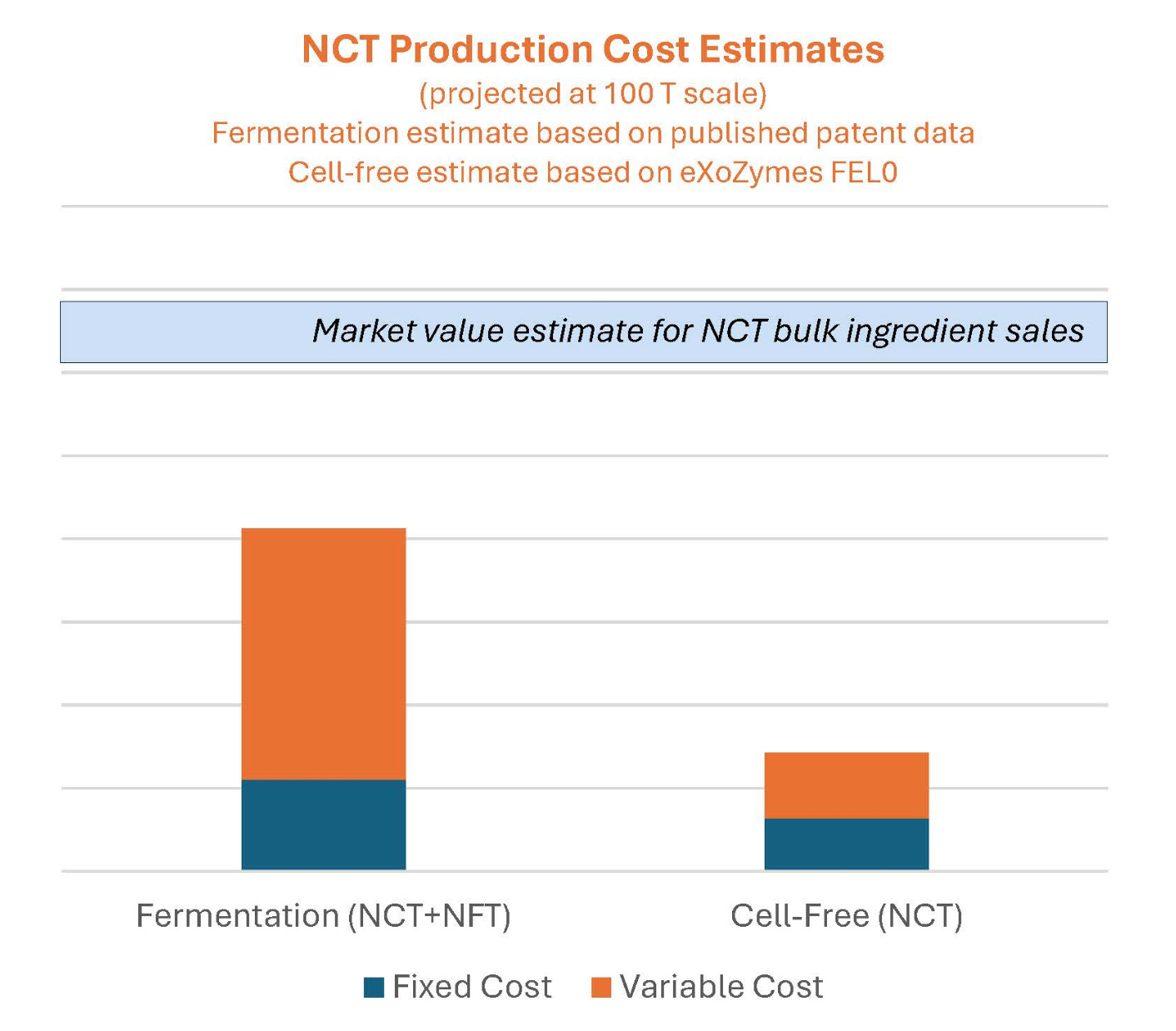

Perriman also presented sales projections for NCT OTC from 2027 onwards, with expected rapid uptake through 2030, suggesting between 3-9 million bottles sold annually. At an illustrative price of US$50 per 30-capsule bottle, this could equate to US$150-450 million per year. Importantly, eXoZymes’ cell-free production approach is modelled to be around 3x cheaper than fermentation-based methods, supporting attractive margins and competitive pricing.

4 - NCT PHARMA TARGETING A POTENTIAL MULTI-BILLION-DOLLAR EXIT IN 3–5 YEARS

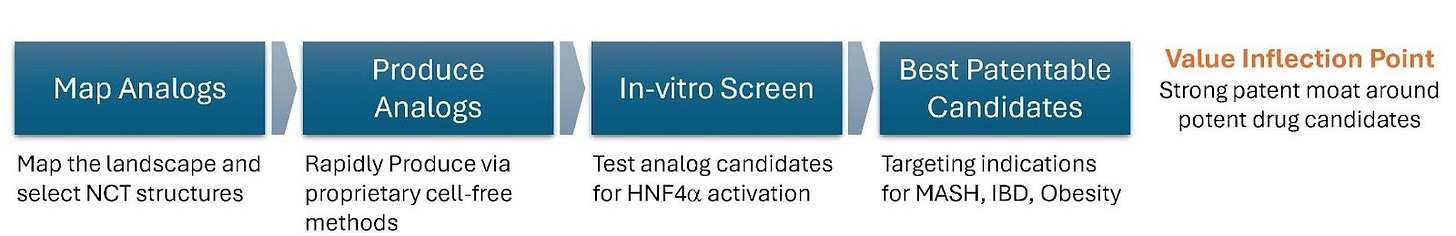

Beyond the near-term NCT OTC opportunity, the Q3 Investor Call confirmed that eXoZymes has formally begun the development of a portfolio of NCT Pharmaceutical analogues, potentially unlocking an even greater value proposition over the medium to long-term.

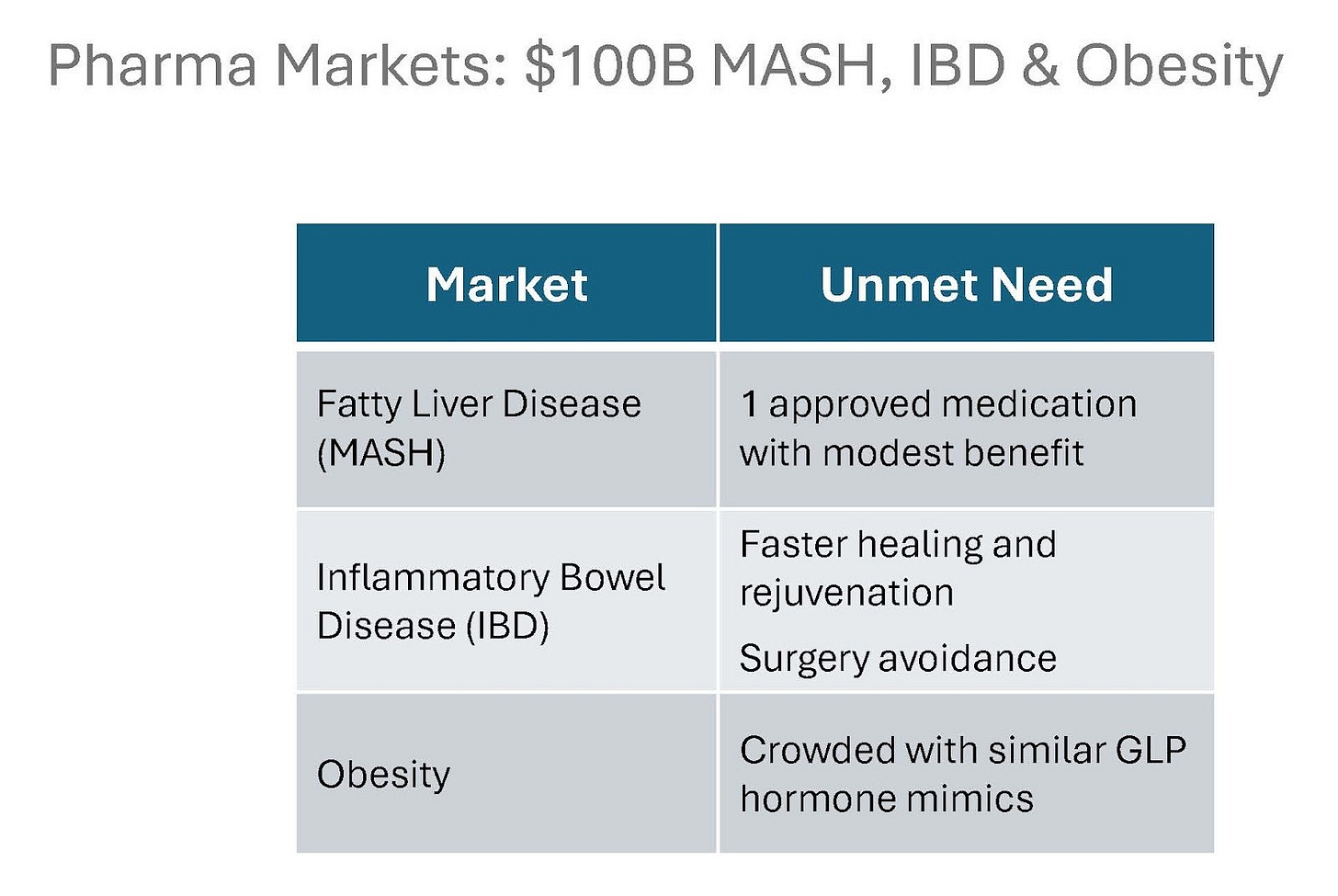

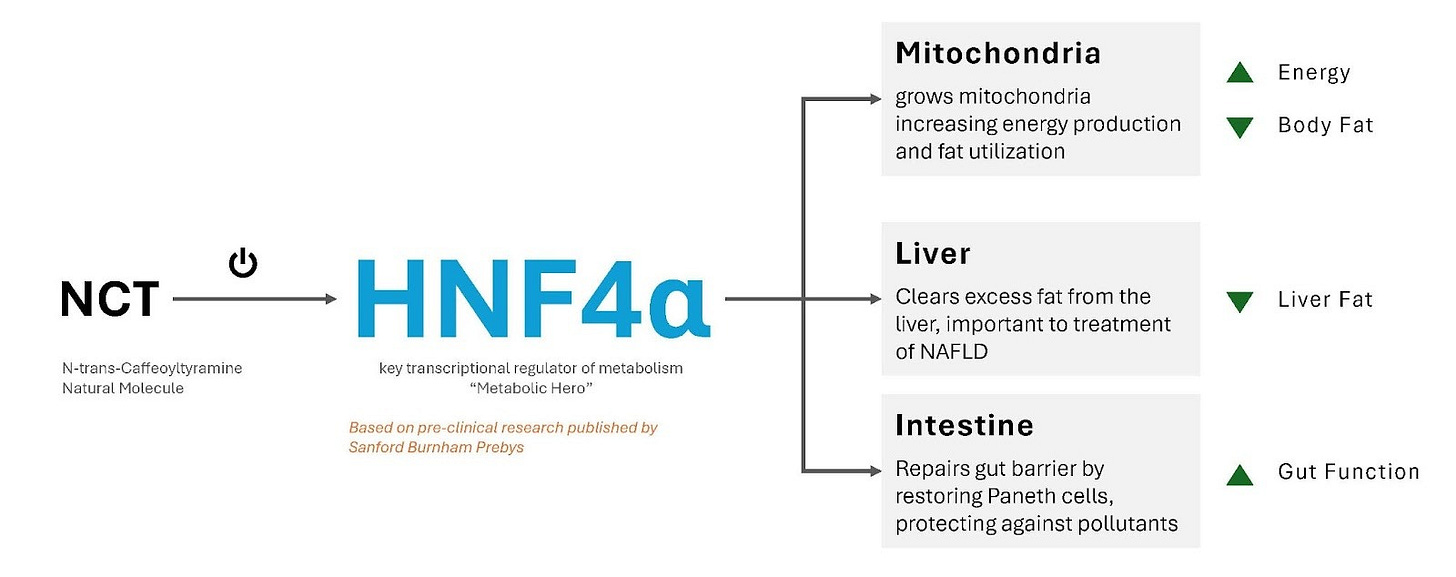

The pharmacological foundation of the NCT OTC and Pharma programme centres on HNF4-alpha activation, a liver nuclear receptor that has historically been difficult to target therapeutically. As potent HNF4-alpha agonists, NCT pharma analogues could address some of the world’s most prevalent and rapidly growing metabolic diseases, including non-alcoholic fatty liver disease (NAFLD), metabolic-associated steatohepatitis (MASH) and obesity. The TAMs for these indications are enormous, estimated at US$100+ billion.

eXoZymes’ technical advantage lies in its ability to synthesise new-to-nature compounds from the natural NCT molecule backbone. This allows the company to design analogues with enhanced pharmacological activity, reduced side effects, improved stability and strong composition-of-matter IP. Critically, these candidates could occupy a greenfield space, as there are currently no selective HNF4-alpha agonists that have achieved clinical approval.

Similar to NCTx’s structure, which holds the licence for NTC OTC, eXoZymes plans to establish a dedicated entity that houses the NCT Pharma asset. As this entity progresses through key technical milestones, its value should increase, at which point eXoZymes intends to partner with organisations capable of advancing the NCT analogues through the full preclinical and FDA clinical development pathway.

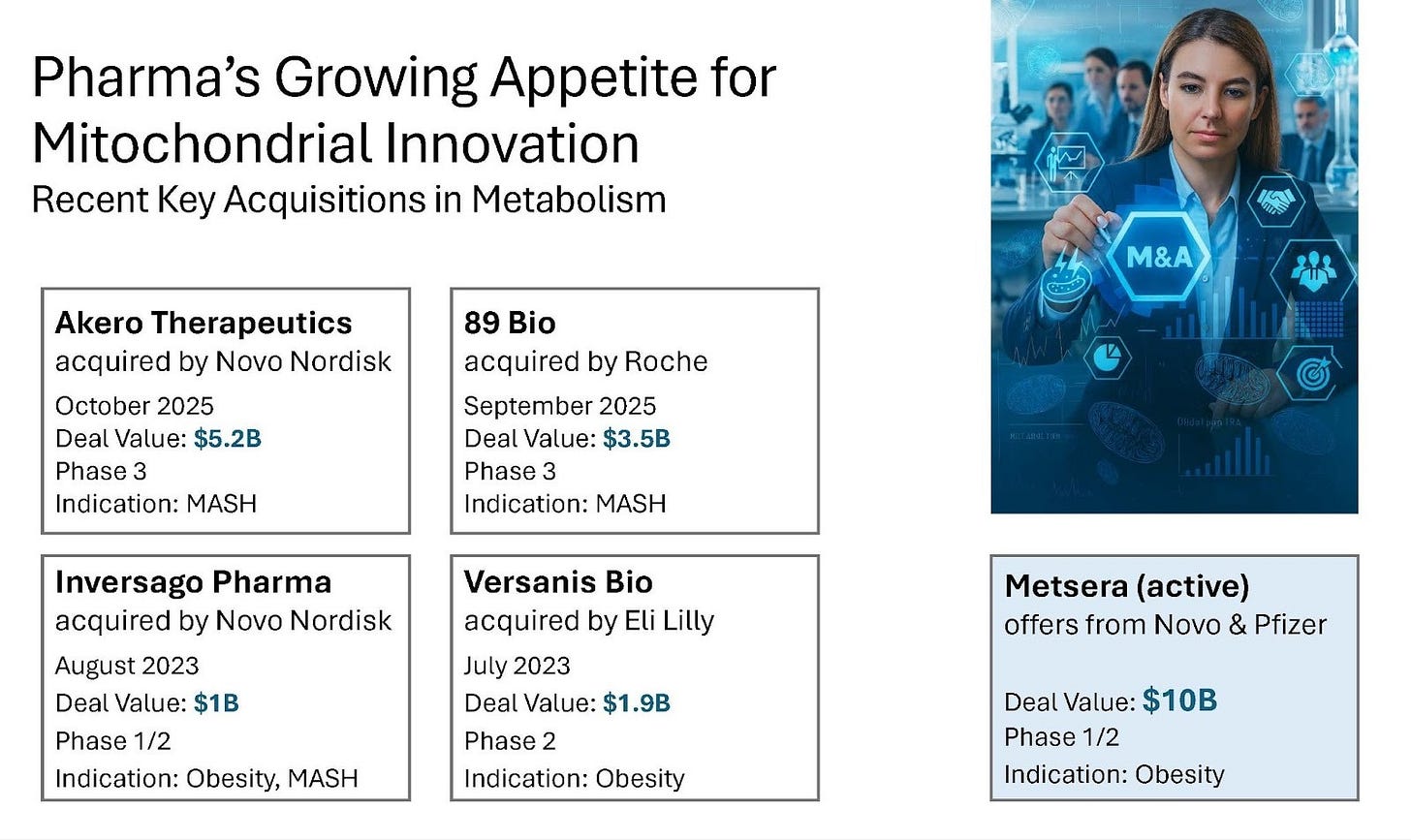

Management has indicated that the NCT pharma entity could support a potential exit in the billion-dollar range within 3-5 years. Recent M&A activities support this view, with Novo Nordisk acquiring Akero Therapeutics for US$5.2 billion in Phase 3 for its experimental MASH drug. Additionally, both Novo Nordisk and Pfizer have active acquisition offers of US$10 billion for Metsera’s Phase 1/2 Obesity drug.

As the NCT Pharma entity will license the core IP from eXoZymes, once sold eXoZymes will still likely receive ongoing licensing revenues linked to production and/or sales of any approved NCT analogues.

5 - NON-INTOXICATING CANNABINOIDS TARGETING US$5.3B+ PHARMA MARKETS

eXoZymes’ second extraordinary business case centres on non-intoxicating, cannabinoid-like molecules, an area where the company’s platform has a distinct technical and regulatory advantage.

Traditional plant-based cannabinoid extraction methods yield complex mixtures of 200+ cannabinoids, containing only trace amounts of rare molecules, which are often co-purified with THC, a Schedule I compound, thereby complicating both purification and federal compliance. Similarly, the limited availability of rare cannabinoids has prevented researchers from understanding which specific cannabinoid molecules drive which biological effects, thereby limiting relevant therapeutic development.

By contrast, eXoZymes’ platform can produce these rare cannabinoids in pure form at an industrial scale, and can also synthesise new-to-nature cannabinoid analogues with zero THC levels. These analogues would share the core chemical scaffolding but differ at specific positions, allowing optimisation of activity while preserving familiarity with the body’s natural endocannabinoid system.

During the Investor Call, management discussed how these non-intoxicating, cannabinoid-like molecules have major pharmaceutical applications in obesity and pain, with a TAM of US$5.3 billion. eXoZymes is one of the few organisations to have received US federal grant funding for cannabinoid research, given that the company can produce cannabinoids with guaranteed zero THC levels, removing the Schedule I restrictions that normally block cannabinoid research at the federal level.

eXoZymes is already in active Joint Venture discussions with various globally leading specialist partners whose capabilities could unlock significantly more value and help ensure the successful commercialisation of the cannabinoid-like program.

6 - DISCIPLINED CAPITAL STRATEGY TO MAXIMISE SHAREHOLDER VALUE

eXoZymes ended the quarter with US$5.1 million in cash and a quarterly net loss of US$2.29 million. The current cash balance provides a runway into early Q2 2026, giving the company time to deliver several key value-inflection milestones.

As previously discussed, eXoZymes has adopted a disciplined capital allocation strategy, supplemented by meaningful non-dilutive government funding. To date, the company has received over US$17 million in grants, which have been instrumental in building its platform. More recently, eXoZymes secured a US$3 million NSF Meta-PURE grant to fund its extraordinary business case in Santalene production, without having to self-fund the program. The company continues to actively pursue additional grant opportunities.

The initial strategic partnerships model for its extraordinary business cases also reduces capital intensity. Rather than paying service providers for their services, eXoZymes intends to offer equity stakes in the relevant licensing entities. At this early stage of the company’s development, this is a highly efficient approach, allowing eXoZymes to avoid major costs associated with taking a compound to commercial readiness, such as CAPEX-heavy facility build-outs.

Given its current cash balance and burn rate, management has been clear that a capital raise is expected in the near term. eXoZymes has explicitly stated its desire to minimise shareholder dilution, particularly at current valuations, so only a modest raise is anticipated.

The company has already been approached by more than 15 institutions, with a range of proposals. Guided by its capital markets adviser, MDB Capital, eXoZymes is focused on securing the best possible terms for the company and its shareholders. With multiple catalysts over the coming months, potential partnership announcements and an extremely thin sell-side, there is a reasonable prospect that any raise could be completed at a higher valuation than today’s share price. The current share count stands at 8.38 million shares, with a total diluted share count of 11.16 million.

Given that 72% of the company is held by insiders amd existing retail investors are holding tight with trading showing sharp price movements on low volume, a capital raise would likely represent one of the few opportunities for new investors to accumulate a large position.

7 - CMOS CONFIRM EXISTING INFRASTRUCTURE IS READY FOR DEPLOYMENT

One of the most significant, and perhaps under-appreciated, points from eXoZymes’ Q3 Investor call was the update on the company’s engagement with external contract manufacturing organisations (CMOs) for NCT OTC scale-up.

During the quarter, eXoZymes contacted 11 CMOs to assess whether they already had the infrastructure required to operate eXoZymes’ NCT OTC platform. All 11 CMOs confirmed that they do. This is a highly material point and strongly validates the capital efficiency of eXoZymes’ scale-up requirements.

Traditional biomanufacturing platforms often require bespoke production facilities, which limits partner optionality and pushes companies towards CAPEX-heavy builds or a narrow set of large partners. By contrast, eXoZymes’ platform can run on standard bioreactor infrastructure, as the technology’s key differentiation sits in the inputs (substrates, engineered enzymes, process design, etc), not in any unique hardware.

Because the required equipment is already installed at existing CMO facilities, scaling future compounds also becomes a matter of routine deployment rather than infrastructure innovation. eXoZymes’ model provides substantial operational flexibility, dramatically reduces CAPEX and offers a clear, lower-risk path to global-scale production for current and future assets. With 11 qualified CMOs at hand, eXoZymes also has substantial negotiating leverage when it comes to selecting partners and structuring deals.

The dual-market approach for NCT really stands out as a smart risk mitigation stragegy. Targeting both nutraceutical and pharma markets from the same R&D feels like a no-brainer when you consider how much capital usally gets burned on single-path development. The fact that 11 CMOs confirmed they already have the necesary infrastructure is huge. That validation alone suggests the scale-up path is far more straightforward than most biotech plays at this stage.

Not sure, whether I understand the exit strategy correctly... Why would they sell good business areas?