eXoZymes Inc: A New Era of Biomanufacturing Chemicals

eXoZymes is revolutionising biomanufacturing with its patented cell-free platform, leveraging optimised enzymes to accelerate sustainable chemical production across nutraceuticals, pharma, and beyond.

JOIN THE EXOZYMES INVESTOR DISCORD CHAT

Company Overview

eXoZymes Inc. (NASDAQ: EXOZ) is a Biotech company engaged in the research and development of its patented biochemical manufacturing platform. Rather than relying on the internal metabolic pathways of organisms, as is the case with cell-based methods, the company has developed a new, groundbreaking method of producing targeted small chemical molecules. This is achieved through harnessing the natural catalytic power of enzymes, engineering them to optimally function in a cell-free environment.

EXOZYMES’ DOMINANCE POTENTIAL

eXoZymes has the potential to disrupt global chemical manufacturing methods with its revolutionary platform innovations, offering unparalleled advantages in R&D speed and cost, high production yields and titres, the use of sustainable feedstocks and a range of other benefits detailed in this report. After a decade of development, eXoZymes’ platform is now ready for commercial launch, finally delivering on the long-held promise that this type of technology could be the Holy Grail solution for biochemical manufacturing.

EXTENSIVE INDUSTRY APPLICATIONS AND PARTNER INTEREST

The versatility of eXoZymes’ platform covers a broad range of high-value markets, including pharmaceuticals, nutraceuticals, and industrial and specialty chemicals like biofuels. With a total addressable market of over $1.4 trillion, eXoZymes Inc. is already engaged in over 100 strategic partnership discussions, including numerous signed non-disclosure Agreements (NDA). eXoZymes recently announced its first subsidiary and expects to announce its first joint venture partnership later in the year.

POWERHOUSE MANAGEMENT TEAM

eXoZymes Inc. is led by a highly experienced and globally renowned team, including industry-leading subject scientists with extensive expertise in enzyme engineering and biosynthesis. The company’s CEO, a seasoned Biotech executive and visionary strategist, has guided multiple startups to industry dominance positions. Additionally, driving the company’s commercial success are two high-calibre business development professionals, the former Chief Business Development Officer of Gevo and the former Director of Business Development at Ginkgo Bioworks.

LACK OF INVESTOR AWARENESS AND LIMITED SHARE FLOAT

Having recently listed on the Nasdaq exchange, eXoZymes Inc. has, until now, maintained a low profile. With founders, insiders and institutions holding over 68.24% of the stock, eXoZymes presents a unique opportunity for early investors to gain exposure in a company with immense growth potential. Additionally, the following Slack Capital report is among the first major coverages of eXoZymes Inc.

In addition to this report, Slack Capital has also released a four-part video interview series featuring key members of eXoZymes’ leadership team. eXoZymes’ recent Investor Webinar and Q1 Earnings Call also detail upcoming milestones and strategic priorities.

JOIN THE EXOZYMES INVESTOR DISCORD CHAT

YouTube Interview Series

To download the Company Report in PDF format, please click the link below.

The report is also available in audio format on YouTube, Spotify and below:

Chemical Manufacturing Industry

Chemicals are the foundational building blocks of our world and their manipulation and transformation drive nearly every aspect of modern life. From extracting natural compounds found in plants to synthesising molecules in modern medicines, chemicals are essential to food production, pharmaceuticals, consumer goods, transportation and many other sectors.

The resulting chemical manufacturing industry is a complex global network focused on the research, development and production of these vital substances. In 2017, the chemical manufacturing industry was valued at over $5.7 trillion and was estimated to contribute roughly 7% to the global economy. In 2020, a comprehensive global report identified over 350,000 chemicals and chemical mixtures registered for commercial production, with the United States of America alone contributing over 2,000 new chemicals each year.

For decades, the industry has relied on resource-intensive chemical production methods that, while effective, have caused significant impacts on environmental degradation, resource depletion and global health. A report released in January 2023 estimated that the chemical manufacturing industry emits up to 1.3 gigatonnes of CO₂e annually, accounting for approximately 2.2% of total global greenhouse gas emissions. The established landscape for modern chemical production relies on three main approaches:

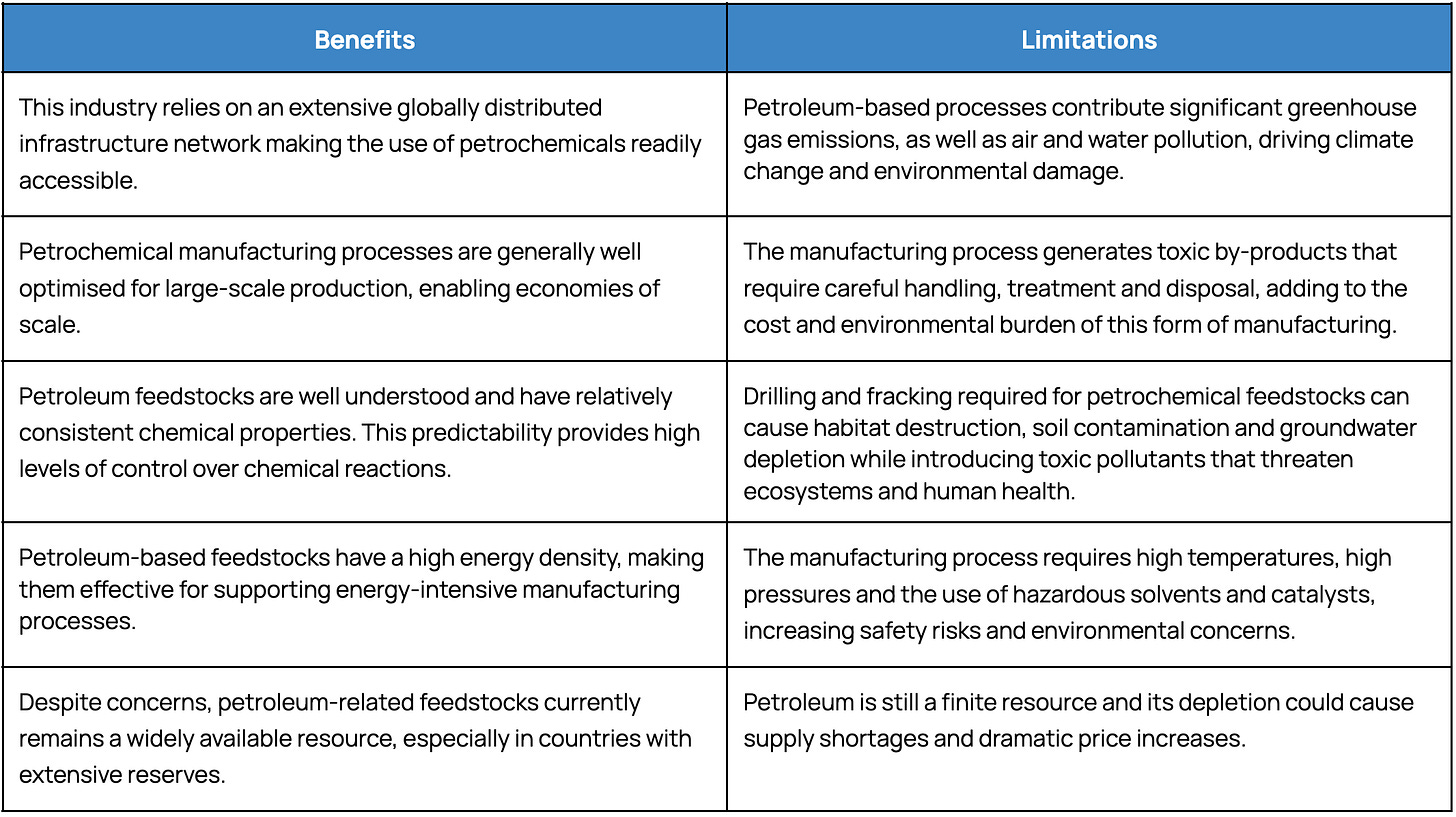

Petroleum-based Manufacturing

Plant-based Manufacturing

1st Generation Cell-based Synthetic Biology

However, as Slack Capital’s report will detail, a new approach is emerging with eXoZymes’ first-of-its-kind cell-free biomanufacturing method.

As the global demand for chemicals continues to grow, the need for more sustainable and efficient chemical manufacturing practices has become paramount. eXoZymes’ innovative platform has the potential to usher in a new wave of chemical manufacturing, unlocking a future of greater environmental sustainability and human well-being.

Petroleum-based Manufacturing

A significant sector of the chemical manufacturing industry focuses on the conversion of crude oil and natural gas into valuable petrochemicals. These non-renewable feedstocks serve as the foundation for many modern products including plastics, synthetic rubber, fertilisers, detergents, solvents, pharmaceuticals and a multitude of other chemicals vital to modern life.

Plant-based Biomanufacturing

Using plant biomass, such as sugars and lipids, plant-based biomanufacturing offers an alternative to traditional petrochemical methods. Using techniques such as fermentation, distillation and solvent extraction, this process manufactures a broad range of products including alcohol, biofuels, pharmaceuticals and other biochemicals.

Synthetic Biology

Synthetic Biology is a collective term for designing and engineering biological systems to create or improve useful products and functions. Synbio aims to biologically solve challenges in medicine, food and agriculture, energy, the environment and beyond. Some of the more recognised applications of Synbio include the cultivation of lab-grown meat from samples of animal tissue as well as Colossal Biosciences’ recent announcement of genetically engineering wolf pups with dire wolf traits, using gene-editing tools.

What has made Synthetic Biology such a promising sector is its power to reshape how we fundamentally engage in daily life. By combining advanced bioengineering tools with modern technological platforms, Synbio has the potential to significantly reduce global impacts on environmental damage, increase resource efficiency to achieve higher yields, reduce raw material supply constraints, develop advanced biomaterials like bio-plastics, as well as deliver personalised medicines that enhance health and extend lives.

The application of Synthetic Biology is so staggering that the Boston Consulting Group estimates that by 2030, Synbio’s application in manufacturing could account for up to $30 trillion to the global economy. Similarly, McKinsey & Company has estimated that up to 60% of the inputs into the world's physical products could, in principle, be produced biologically.

Synbio’s recent expansion has stemmed from the development of modern technology platforms supported by a surge of investment and a collective rally to tackle global challenges.

On the technology front, platforms such as CRISPR-Cas9 gene editing, DNA sequencing and synthesis, AI-driven design, automated biofoundries, synthetic genomics, directed evolution and metabolic engineering have enabled synthetic biology to become meaningfully applied. While investment in the Synthetic Biology sector has recently stagnated, in 2023 Synbio startups raised over $6.9 billion, down from 2021 funding of over $20 billion. This decline in investment is likely attributed to the numerous technical challenges still present which have slowed the progression and adoption of early-stage Synbio platforms.

Synthetic Biology still has a promising future, yet many innovations still remain in the research or pilot stages. Scaling these platforms for industrial applications requires overcoming numerous technical, regulatory and economic hurdles. Companies that showcase tangible evidence of their platform's ability to effectively scale and maintain cost-efficiency will be among the companies that drive Synbio’s revolution forward.

1st Generation Cell-based Chemical Manufacturing

One such sector of Synthetic Biology which has struggled to demonstrate broad success is 1st Generation Cell-based biochemical manufacturing. These technology platforms harness the internal metabolic pathways of cells, where scientists use modern tools to reprogram microorganisms to produce targeted small chemical compounds.

1st Generation Cell-based SynBio typically starts by identifying and isolating the specific genes that encode the enzymes responsible for producing a targeted compound. These genes are then inserted into a microorganism's DNA, reprogramming it to synthesise the chemical. These modified cellular organisms are then grown in a bioreactor, where they are fed nutrients, such as sugar, to promote cellular growth and ultimately produce the targeted chemical.

Although initially hailed as a viable solution for sustainable chemical production, cell-based Synthetic Biology has yet to overcome numerous limitations, ultimately hindering its economic viability and industrial adoption. Bold claims from companies like Ginkgo Bioworks and Zymergen were made however, the inherent complexities of controlling living organisms proved too difficult, leading to inconsistent results and high development costs.

At their peak, cell-based biomanufacturing companies like Ginkgo Bioworks and Codexis saw their market cap expand to $27.3 billion and $2.7 billion. Today, these companies' values have collapsed to $461 million and $218 million respectively, leaving many investors and stakeholders holding substantial losses. This has partially tarnished the optimism towards Synbio’s near-term prospects for sustainable biochemical production.

It is important to note that eXoZymes Inc. is not a Synthetic Biology company. Its platform does not use living cells but instead operates entirely outside the cell through its proprietary, cell-free Exozyme System platform.

Cell-Free Systems

Unlike cell-based platforms which rely on the highly complex systems of a living cell, "cell-free" technologies offer a more controlled approach by utilising purified, non-cellular biological components, such as isolated proteins and nucleic acids.

This distinctive technique has enabled the development of numerous biotechnological tools. For example, the approach is currently used in cell-free DNA/RNA analysis, allowing for non-invasive genetic examination in diagnostics and monitoring activities. Cell-free protein synthesis enables the controlled production of specific proteins for research and therapeutic development. Notably, cell-free biomanufacturing, the space in which eXoZymes Inc. operates, leverages enzymes to biomanufacture small chemical molecules without the need for living organisms.

Although these various applications all fall under the term "cell-free," it is important to note that each method operates with fundamentally distinct objectives, mechanisms, and processes.

eXoZymes’ Revolutionary Platform

eXoZymes Inc. has developed a groundbreaking cell-free manufacturing platform that enables enzymatic biocatalysis to occur outside living cells. This technology ushers in a new paradigm in biochemical manufacturing, distinctly separate from 1st Generation Cell-based Synthetic Biology.

Functioning similar to a chemical reaction in a bioreactor environment, eXoZymes’ platform leverages its engineered enzymes, termed “Exozymes”, in an Exozyme System to convert bio-based feedstocks into targeted small chemical compounds.

A comprehensive study on the science behind the company’s platform can be found in the following publication: The Bio-inspired Cell-Free Approach to Commodity Chemical Production.

Additionally, the GEN Biotechnology journal recently featured a cover story by eXoZymes Inc., where the company introduced the new scientific terms ‘Exozymes’ and ‘Exozyme Systems’.

Enzymes and Exozymes

Enzymes, primarily found inside cells, are specialised proteins that facilitate the breakdown and conversion of chemical substrates. These biocatalysts are considered a cell's biological workhorse, accelerating the chemical transformation process of biocatalysis.

To synthesise intracellular enzymes, a cell transcribes genetic instructions from its DNA into messenger mRNA molecules. Ribosomes, the cell’s tiny protein factories, then use this mRNA to assemble the proteins which become enzymes. Enzymes are naturally adapted for cellular environments, where cells can maintain optimal temperature, pH, cofactor levels and protection from external stressors. Outside a cell’s regulated environment, enzymes can quickly denature and lose their stability and efficiency as biocatalysts.

Exozymes

Exozymes are enzymes that naturally function or are engineered to function outside a cell (cell-free) to produce small chemical molecules. Exozymes’ distinct feature over intracellular enzymes is their ability to maintain biocatalytic performance in the extreme conditions of industrial biomanufacturing applications. This is due in part to their unique traits that may have been engineered for optimal stability, activity, and specificity under conditions that would typically impair intracellular enzymes. Importantly, while all Exozymes are enzymes, not all enzymes possess the necessary traits to be Exozymes.

Common Extracellular Enzymes vs. Optimised Exozymes

While enzymes are conventionally associated with cellular processes, their application beyond the cell is already established in a range of commercial products and industrial applications. For example, optimised protease and lipase enzymes in laundry detergents are used for single biocatalysis processes to break down stains on our clothing.

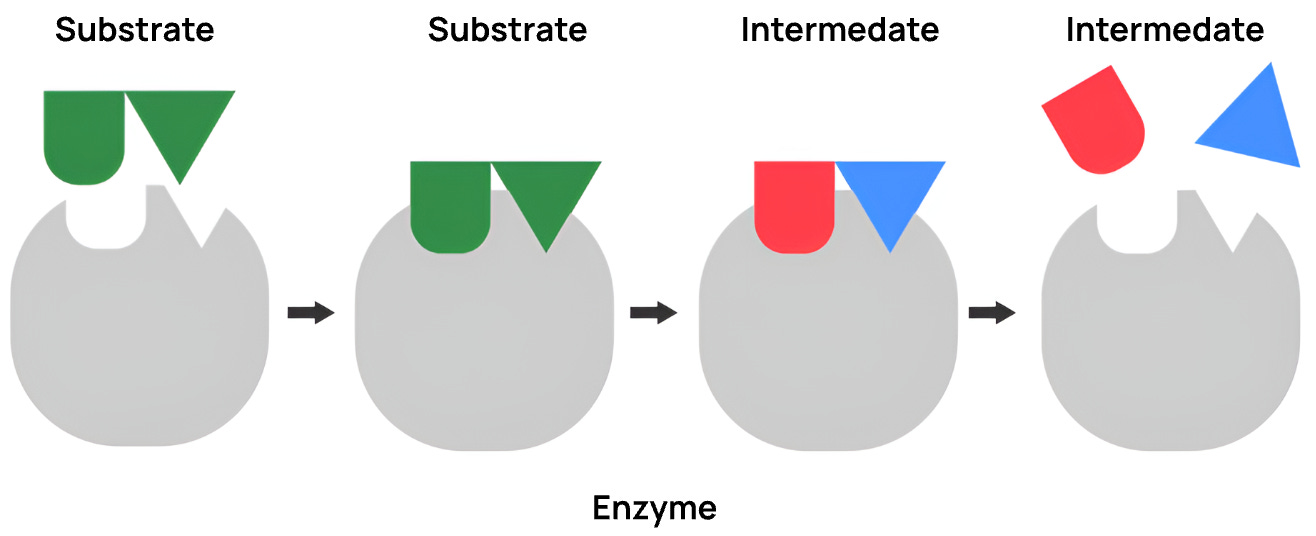

Biocatalysis and Exozyme Systems

In order for enzymatic biocatalysis to occur, a substrate must bind to an enzyme's active site, which is precisely shaped to fit that feedstock molecule. Once bound, the enzyme stabilises the substrate's transition state and facilitates the rearrangement of electrons to break or form new chemical bonds.

These reactions often require cellular cofactors, such as ATP or NADPH, to provide energy to assist in electron transfer. Following this reaction cycle, the enzyme then releases the intermediary and returns to its original state, ready to catalyse another reaction.

Converting an initial feedstock into a target chemical compound relies on numerous enzymatic pathways, with each module converting one intermediary to the next during biocatalysis.

Module 1: Feedstock (Substrate A) → Intermediate B

Module 2: Substrate B → Intermediate C

Module 3: Substrate C → Intermediate D

Module X: Substrate X → Targeted Chemical Compound

Exozyme Systems

Exozyme Systems are specifically designed biochemical pathways that utilise Exozymes as well as essential elements to enable efficient industrial production of valuable small molecules outside of a living cell. A key feature of Exozyme Systems is their ability to integrate elements such as cofactors, chemical reagents, and environmental control components to achieve continuous, efficient, and cost-effective cell-free bio manufacturing.

A significant advantage of Exozyme Systems lies in its cost-effectiveness and scalability, which is often a substantial barrier associated with traditional cell-based biomanufacturing platforms. This is largely due to Exozyme Systems ability to bypass the metabolic limitations in a living cell.

The Platform’s Three Phases

eXoZymes has developed three distinctive phases, establishing itself as a dominant R&D leader in the cell-free biomanufacturing sector. These phases, inspired by recent Nobel Prize-winning chemistry awards and proprietary AI-driven technology, create a highly efficient, scalable and cost-effective biomanufacturing platform.

The company recently showcased its R&D effectiveness, developing a new target compound from concept to synthesis in mere weeks, a feat that stands in stark contrast to the years of chemical development typically required for traditional and Synbio platforms.

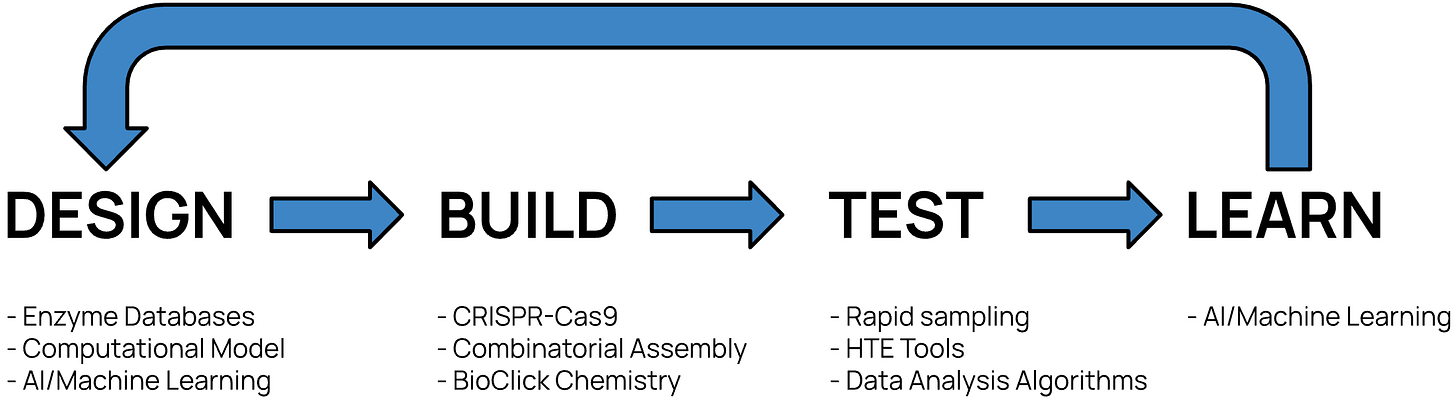

Phase 1. Exozyme Design & Development Cycle

eXoZymes’ core strength and leadership advantage lies in its rapid and iterative Design, Build, Test and Learn (DBTL) cycle. This unique system generates valuable data and insights, enabling scientists to optimally engineer enzymes into Exozymes for the company’s Exozymes System.

Design: Enzyme Identification and Optimisation

The initial stage of the DBTL cycle begins by analysing the molecular structure of a targeted chemical compound to determine the required Exozyme System elements including the biocatalysis pathways and optimisations for its Exozymes. Using this information, the company then leverages internal and external protein/enzyme databases along with a high-performance Computational Protein Design model to rapidly screen extensive libraries that identify potential enzyme candidates theoretically capable of synthesising the targeted compound.

After identifying initial enzyme candidates, eXoZymes utilises its proprietary AI/Machine Learning model, which has been trained on extensive datasets from previous DBTL cycles. This model analyses the structural and functional characteristics of the enzyme candidates and highlights specific mutations or modifications that could further enhance the enzyme's performance.

By integrating eXoZymes’ AI model into its design ecosystem, it dramatically increases the R&D time efficiency and success rate in selecting the most appropriate enzyme optimisations. To complement its AI-driven approach, eXoZymes also leverages Directed Evolution (2018) principles, iteratively introducing targeted genetic mutations and selecting variants with superior traits.

Build: Creating and Preparing Exozymes

The Build stage then produces these engineered enzymes into ultra-pure and highly bioactive Exozymes. To synthesise the optimised Exozymes, the company selects an appropriate microbial host, such as E. coli, based on its ability to efficiently express the recombinant Exozyme proteins. The company utilises CRISPR-Cas9 gene-editing technology (2020) to precisely edit microbial host genomes and insert the engineered Exozyme genes into these sites. These modified microbes are then cultured in a bioreactor to produce the desired Exozymes.

Following fermentation, the synthesised Exozymes are then purified using chromatography techniques, such as affinity chromatography, ion-exchange chromatography and size-exclusion chromatography. The results of these methods create ultra-pure and highly bioactive Exozymes that are free from impurities.

To rapidly identify optimal reaction conditions, the company uses its pioneering BioClick platform, inspired by Bio-orthogonal Click Chemistry (2022). This technique enables precise group transfer reactions that modify target compounds using the surgical precision of Exozymes. Additionally, immobilisation techniques are used to anchor the Exozyme to solid supports, enabling its reuse across multiple batches and thereby reducing production costs.

As the targeted compound is still in its R&D phase, eXoZymes only produces microgram quantities of Exozymes, enabling the company to conduct research to inform future development efforts.

Test: High-Throughput Experimentation

The Test stage then evaluates the performance of the engineered Exozymes System and its components in bioreactor conditions, identifying the best Exozyme candidates for further optimisations.

eXoZymes leverages its AI model to generate hundreds of proposed experiment parameters, including varying Exozyme concentrations, substrate types, cofactor levels, or reaction conditions. The company then uses High-Throughput Experimentation (HTE) to test all these experiments in parallel, exploring a vast array of Exozyme System possibilities. The use of Automated liquidity-handling robotics is employed to ensure precise experimental setups.

Each experiment is then conducted with key biocatalytic flux metrics such as reaction rates, product yields, titres etc. measured via techniques such as mass spectrometry.

By conducting experiments in parallel, HTE significantly increases the speed and efficiency of eXoZymes’ R&D efforts while dramatically reducing the cost per experiment.

Learn: Data Capture and Iterative Improvement

These extensive experimental datasets are then integrated into eXoZymes’ AI model, which identifies subtle patterns or relationships from the hundreds of experiments.

For example, the AI model may detect a specific enzyme mutation that consistently enhances an Exozymes’ stability or activity. This mutation will then be prioritised in subsequent Design phases.

This wealth of data from the testing phase continually refines and accelerates eXoZymes R&D efforts. With each DBTL cycle, eXoZymes’ AI model improves its accuracy in optimisation recommendations, strengthening its predictive capabilities. This accumulated internal database is a significant strategic asset, enabling eXoZymes to tackle increasingly complex chemical synthesis applications with greater effectiveness.

Phase 2. Scaling Exozyme Production

Building on the lab-scale synthesis achieved in the DBTL cycle, Phase 2 of eXoZymes ’platform focuses on scaling Exozyme production to meet commercial requirements.

The company uses relatively standard bioreactor infrastructure to ferment microbial hosts and synthesise its required Exozymes. Once expressed, the Exozymes are then harvested and purified using specialised cell harvesting, lysis, chromatography and lyophilisation techniques.

While the current infrastructure at eXoZymes’ Monrovia, California facility can meet early market demand requirements, scaling Exozyme production for high-volume applications, such as biofuels, will require extensive bioreactor and purification systems. In the future, eXoZymes plans to leverage partnerships with leading enzyme manufacturers, such as Novozymes, for cost-effective and industrial-scale Exozyme production.

Phase 3. Exozyme System Synthesis Process

To synthesise the targeted chemical compound, Phase 3 begins feeding the selected bio-based feedstock, optimised Exozymes, catalytic amounts of high-energy cofactors, such as ATP and NADPH, as well as other reagents into a bioreactor to initiate the Exozymes Systems biocatalysis cycle. The type of feedstock used will depend on the target chemical and may include glucose from corn or sucrose from sugarcane.

Over time, Exozymes convert the feedstock through precisely engineered modular pathways. During each biocatalysis module, bioreactor conditions such as the temperature and pH levels are optimised to ensure maximum conversion efficiency. Depending on the molecular complexity of the targeted compound, an Exozymes System may require only a few modular steps while more complex compounds like pharmaceuticals, could involve 30+ steps.

Following the completion of the entire biocatalysis cycle, the synthesised compound is then extracted from the bioreactor. As traces of Exozymes, cofactors and other byproducts may be present in the reaction mixture, downstream processing such as filtration and recrystallization may occur. However, as eXoZymes’ platform can achieve near-theoretical yields, the targeted compounds’ concentration and purity levels are extremely high.

To ensure that the biocatalysis cycle continuously operates efficiently over time, the cofactors, such as ATP and NADPH, must be regenerated from their spent forms, ADP and NADP+. To achieve this, eXoZymes has developed separate modular pathways alongside the main reaction cycle to regenerate ADP into ATP and NADP+ into NADPH. Additionally, the platform incorporates proprietary autoregulatory systems, such as a purge valve and molecular rheostat, to balance cofactor levels and enable long-term synthesis operations without needing to shut down the platform.

Notably, the synthesis of the targeted chemical compound in Phase 3 can occur in relatively standard bioreactor infrastructure. Unlike cell-based systems which require specialised equipment to sustain living organisms, the platform's distinction comes from its precisely engineered Exozymes and reagents, enabling complex synthesis and high yields to occur without the need for bespoke and CAPEX-intensive infrastructure hardware.

Global transformation through eXoZymes’ Platform

At the heart of eXoZymes’ mission is to transform the world through accessible, sustainable and innovative biomanufacturing solutions. With its unique capabilities, eXoZymes’ platform can overcome the numerous limitations of traditional chemical production methods, establishing a new benchmark for creating the essential chemicals for modern life.

Platform Development Journey

eXoZymes’ development began in 2008 when Tyler Korman, VP of Research, joined James Bowie's lab at UCLA, a world-renowned centre for synthetic biochemistry research. At the time, the team began researching cell-based biofuel solutions with funding from the US Department of Energy (DOE). While results were encouraging, the inherent complexities of the cell-based process highlighted the significant limitations of this system.

Building on their research, in 2013, Prof. Bowie directed Dr. Korman and team member Dr. Paul Opgenorth, VP of Development, to shift their focus towards cell-free metabolic engineering. In the years that followed, the team investigated, established and enhanced its revolutionary and patented biomanufacturing platform. As detailed later, the team began publishing their findings in leading scientific journals, including Nature Chemical Biology and Nature Communications.

In 2019, MDB Capital identified the emerging platform technology concept at the ARPA-E Energy Innovation Conference. At the time, the concept lacked formal company structure and commercial rollout strategies, yet MDB recognised the immense potential of the platform and supported the establishment of Invizyne Technologies (now eXoZymes Inc.). MDB Capital’s co-founders, Chris Marlett and Anthony DiGiandomenico, provided $5.9 million in funding to license the technology from UCLA and formally register the company.

In November 2024, eXoZymes Inc. listed on the Nasdaq Exchange, raising $15 million. In February 2025, the company underwent rebranding efforts, changing its name from Invizyne Technologies to eXoZymes Inc.

Commercial Rollout

eXoZymes Inc. is primarily engaged in the research and development of its three distinct phases related to its biomanufacturing platform. Whilst the company’s current facilities can synthesise small volumes of its targeted chemical compounds, eXoZymes plans to strategically partner with industry players who will integrate the company’s platform into their existing biomanufacturing infrastructure. This calculated approach ensures that eXoZymes can retain its focus on maximising the transformative potential of its innovative platform solution.

This "Pick & Shovel" approach enables the company to remain capital efficient, generate significant revenue opportunities, and deliver substantial value to its shareholders.

eXoZymes’ platform solution has already attracted significant industry interest, with over 100 active discussions alongside 35 new partner prospects from the SynBioBeta Conference held last week. Typically, companies approach eXoZymes Inc. to overcome one of the following:

Inability or difficulty in biomanufacturing chemical compounds through existing methods

Desire to develop a novel compound or improve a compound’s current characteristics

Reduce production costs, as existing methods are economically unfeasible

Given the widespread interest in the company’s platform, eXoZymes is strategically assessing all commercial avenues, aiming to balance financial and operational interests with shareholder value.

To this front, eXoZymes Inc. has identified the nutraceutical with pharmaceutical potential sector as its initial target market, given the industry's demand for low-volume, high-value compounds. This strategic focus aligns with the company’s current biomanufacturing capabilities, which can synthesise kilogram quantities of chemical compounds. Additionally, with the support of the DOE’s NREL division, eXoZymes has also identified biofuels, such as Isobutanol for Sustainable Aviation Fuel, as an additional initial market focus.

As the company advances its operational capabilities, eXoZymes Inc. plans to commercially expand its platform into the food, flavours and fragrances markets as well as the larger-volume, lower-value markets, such as industrial and specialty chemicals. Despite the platform's inherent scalability, these markets require metric ton quantities of chemical compounds, extending beyond the company’s initial rollout focus.

Although the fundamental science behind eXoZymes' platform is currently mature from a development standpoint, the company anticipates significant growth to occur once partnership agreements begin. This ensures that the company can scale its operations alongside its deal growth, including the expansion of its current 31-person team.

Initially targeting the nutraceutical with pharmaceutical markets, eXoZymes’ platform must adhere to the FDA’s Good Manufacturing Practices (GMP) for safety, efficacy and quality standards. Additionally, as eXoZymes Inc. plans pharmaceutical partnerships, its developed compounds will be subject to the often lengthy FDA approval process. This is a major reason why eXoZymes is strategically targeting this industry early to seize revenue opportunities sooner.

Strategic Partnership Selection

Collaborating with appropriate partners is critical for commercialising eXoZymes’ developed compounds. The following qualities may be evaluated when assessing a partner's compatibility and strategic alignment:

Spin-Outs

Spin-out deals occur when XoZymes identifies a chemical compound with significant interest and high-value market potential. The company then initiates R&D efforts to the related chemical compound, as previously outlined in Phase 1, to demonstrate the scientific viability and lab-scale production abilities of its developed Exozyme System.

After validating the system through laboratory testing, eXoZymes forms a fully owned subsidiary, separate from the parent company. The developed compound asset and its proprietary rights are then transferred to this subsidiary, with eXoZymes continuing to provide the necessary funding, platform access, and technical support.

As the compound achieves further development milestones, for example synthesising ten kilograms worth in eXoZymes’ lab, the underlying asset and therefore the subsidiary's economic value increases. Once eXoZymes Inc. has determined that the asset has reached close to its maximum commercial value within the parent company, the subsidiary is spun out through a partial sale of ownership to an external partner. This partner will contribute additional expertise, further increasing the economic value of the commercial asset.

The percentage of equity sold in the subsidiary is largely dependent on the significance of the market opportunity and the development stage of the compound asset.

As will be further discussed, eXoZymes recently launched its first fully-owned subsidiary, NCTx, marking the company’s transition to commercialising its technology platform.

Beyond NCTx, eXoZymes is actively developing its portfolio of compound assets, increasing their underlying economic value before transferring them to subsidiary companies.

Joint Ventures

eXoZymes also plans to pursue joint venture (JV) partnerships to commercialise its asset compounds. Unlike spin-out deals, which involve partnership collaboration once an asset nears its maximum value through the company's R&D efforts, JV deals bring in a partner much earlier in the asset development process.

Joint venture partnerships combine eXoZymes’ R&D strength with a partner’s complementary expertise, as previously detailed. Depending on the market opportunity, involving a partner early can accelerate the likelihood of an asset's commercial success, spread the risk of development, and dramatically increase the asset’s economic value.

To initiate a JV partnership, a separate entity is formed with cost-sharing and profit-split structures based on equity ownership. eXoZymes will continue to actively develop the asset, further optimising the compound's performance, reinforcing its market competitiveness and significantly improving its chances of commercial success.

In a recent Investor Webinar, the company detailed that it expects to announce its first joint venture partnership later this year, with indications that the partner could be a leader in the global nutraceutical/pharmaceutical sector.

Licensing Agreements

In the future, once eXoZymes' innovative platform becomes a recognised leader in the global chemical biomanufacturing sector, the company will begin initiating licensing deal agreements as part of its broader commercialisation strategy.

Licensing agreements grant external partners the rights to incorporate eXoZymes’ platform solution into their existing biomanufacturing processes. In return, eXoZymes may receive upfront payments or royalty compensation based upon the assets sales or use. Licensing agreements offer a low-risk, scalable way for eXoZymes to expand its platform's reach and revenue generation.

The deals for the developed assets can be exclusive or non-exclusive, depending on the market opportunity and volume demand. The licensee assumes responsibility for manufacturing, distribution and customer engagement, while eXoZymes continues to support its partners with technical assistance.

NCTx - eXoZymes’ First Subsidiary

Recently, eXoZymes Inc. established its first subsidiary, NCTx, LLC, focused on developing and producing N-trans-caffeoyltyramine (NCT). This bioactive compound has attracted increasing attention due to its diverse nutraceutical and pharmaceutical applications.

eXoZymes’ innovative platform enabled the rapid development of its NCT compound, moving from concept to targeted demonstration in just 6 weeks. This accelerated development timeline highlights the platform's highly efficient R&D efforts compared to the years-long chemical development timelines typical in the biotech and synthetic biology sectors.

N-trans-caffeoyltyramine

NCT is a naturally occurring compound present in a range of plant sources, including the husk of the hemp seeds, Lycium chinense (goji berry), and Tribulus terrestris.

Despite hemp seed husks having the highest concentration of NCT, a 2019 study found that NCT’s highest concentration level was just 83.2mg per 100g or 0.0832%. Considering that the husks represent a small percentage of a hemp plant's total biomass, NCT’s overall concentration within a plant is substantially low. Due to this reason, it makes extracting and purifying sufficient quantities of NCT extremely challenging and expensive.

Commercial Applications

NAFLD/MASLD and MASH Treatment

Research has provided compelling evidence of NCT's potential in treating Non-Alcoholic Fatty Liver Disease (NAFLD), now often called MASLD, and its more severe form, Metabolic Dysfunction-Associated Steatohepatitis (MASH). These conditions involve excessive fat buildup in the liver, with MASLD representing the most common chronic liver disease worldwide, impacting over 30% of the global population and over 100 million people in the US. Given the association with cirrhosis, liver failure, liver cancer, and increased risk of liver transplantation or premature mortality, effective treatments are urgently needed.

Through studies conducted on mice, NCT demonstrated activity on the HNF4α protein, promoting lipophagy (a fat-breakdown process) and enhancing mitochondrial function for more efficient fat burning. Over the 10-week study, mice fed on a high-fat diet supplemented with NCT weighed 10g less than those on a high-fat diet alone, representing a 35-40% difference in body weight. Additionally, a separate study validated NCT's effectiveness in reversing liver fat accumulation through lipophagy and in decreasing a blood marker typically associated with liver damage.

Notably, current MASLD treatment relies primarily on lifestyle interventions such as diet and exercise. There are currently no specific drug treatments approved for the MASLD condition. However, type 2 diabetes medication and Vitamin E can offer indirect liver health benefits.

Recently, the FDA approved Rezdiffra™, the first therapy specifically for treating MASH however, the related drug market is expected to expand with several other late-stage drugs in development.

With rising global obesity and diabetes rates, the global MASLD treatment market was estimated to be $23.40 billion in 2025 and is forecasted to reach $36.94 billion by 2030. NCTS’ use in obesity and weight management also represents another promising area of research, with the treatment market expected to reach $100 billion by 2030.

Gut Health & IBD Support

There is also evidence that NCT may have significant benefits on gut health and Irritable Bowel Disease (IBD). IBD is a chronic inflammatory condition of the gastrointestinal tract, causing symptoms such as abdominal pain, diarrhea, and rectal bleeding. IBD can increase the risk of strictures and colorectal cancer. Globally, over 4.5 million individuals suffer from IBD.

In a preclinical study on mice fed a high-fat diet with NCT supplementation, the results showcased that the compound upregulated a variety of genes related to gut inflammation. NCT was also demonstrated to support the function of Paneth cells, which are essential for maintaining the intestinal barrier and secreting antimicrobial peptides. A 3-week human study is currently exploring NCT's impact on intestinal barrier function.

Current treatments for gut impermeability and IBD conditions include anti-inflammatory drugs and immunosuppressants, as well as nutraceuticals like probiotics and curcumin. Brightseed Bio Gut Fiber™ is currently the only product on the market containing the NCT compound, yet in small quantities.

The broader gut health treatment market was valued at $51.7 billion in 2023 and is projected to reach $106.4 billion by 2032. Similarly, IBD treatment is expected to rise from $22.9 billion in 2024 to $33.9 billion by 2033.

Commercial Partners

To commercially distribute its NCT compound, eXoZymes Inc. will partner with external parties who have the necessary expertise to ensure rapid market access and successful asset sales.

eXoZymes will initially target the nutraceuticals sector, hoping to have its NCT product achieve Generally Recognised As Safe (GRAS) ingredient status with the FDA. This process can take up to 180 days for the FDA to issue a response to a notification.

Additionally, as eXoZymes’ platform allows for engineering adjustments to optimise its Exozymes, the company can synthesise NCT analogues with significantly enhanced compound traits, offering a more effective form of treatment. However, these compound analogues will require extensive clinical trials and FDA approval for disease treatment and prevention applications.

Initial Market Applications

Nutraceutical Ingredients

TAM: $105 billion

As health and wellness increasingly drive global lifestyle choices, nutraceutical compounds provide a targeted blend of nutrition and health benefits. This thriving sector produces concentrated forms of dietary supplements, functional foods and beverages packed with bioactive ingredients like vitamins, minerals, antioxidants and herbal extracts.

Unlike the pharmaceutical industry, which requires rigorous clinical trials and approvals, the production of nutraceutical compounds operates under lighter regulations, enabling faster market entry. Generally Recognised As Safe (GRAS) standards, set by the US FDA, require accurate nutraceutical labelling, safety testing and quality control to ensure high compound purity.

The nutraceuticals industry relies on the production of high-quality, low-volume compounds often extracted or synthesised from various plant-based feedstocks. A single compound is frequently used across multiple products, providing attractive commercial deal opportunities.

Nutraceuticals’ existing production methods face numerous challenges including low compound yields from plant-based extraction methods, high feedstock costs and continuous supply constraints due to climate change, resulting in infrequent batch production. Additionally, nutraceutical compounds often have low stability and reduced shelf life.

eXoZymes’ platform can offer advantages through delivering high compound production yields and titres, which ultimately boost profit margins. The platform can also use widely available biomass feedstocks, reducing reliance on expensive and rare feedstocks, like ginseng root. The company can enhance the performance of compounds, increasing bioavailability and absorption, while also synthesising new-to-nature compounds. The platform also provides on-demand chemical synthesis, producing compounds year-round beyond plant harvest seasons.

Scientific Report - Terpene

In 2017, Korman, Openorth and Bowie released a scientific report demonstrating the platform's ability to produce the terpene compounds of Limonene, Pinene and Sabinene from 27 Exozymes and inexpensive glucose feedstock over 5 days.

Terpenes are naturally occurring compounds providing characteristic aroma scents, such as Limonene (citrusy, lemon-orange scent), Pinene (pine-like scent) and Sabinene (spicy, woody-citrus scent). These molecules are used across a diverse range of industries, including food flavours and fragrances, commodity chemicals, pharmaceuticals and biofuels.

The study demonstrated eXoZymes platform’s performance, achieving results of:

Limonene: 88% yield and a titre of 12.5g/l

Pinene: 104% yield and a titre of 14.9g/l

Sabinene: 95% yield and a titre of 15.9g/l

The Exozyme System operated continuously over five days, requiring no additional Exozymes, cofactors or reagents, proving the platform's operational efficiency and cost-effectiveness. The published results were an order of magnitude greater than cell-based terpene production, which faces challenges from cellular toxicity and substrate competition.

The 2017 report indicated that with further optimisations to the Exozymes Systems and selected Exozymes, the platform's performance could be further increased and expanding the possibility to synthesise additional terpene compounds such as Sesquiterpenes and Diterpenes.

Pharmaceutical/Active Pharmaceutical Ingredients

API TAM: $255 Billion

The pharmaceutical industry is a critical element to the global healthcare system, focusing on the research, development and distribution of medicines that enhance and support human health. Central to this industry is the production of Active Pharmaceutical Ingredients (APIs), which are the bioactive compounds in pharmaceuticals that provide the intended therapeutic effects.

The API industry typically produces small quantities of ultra-pure chemical compounds, which are later formulated into targeted final products such as pills or tablets. API companies must follow strict regulations set by agencies such as the FDA or Europe’s EMA to ensure safety, quality and effectiveness. The regulatory process for an API often takes years of R&D and clinical trials, with approval never guaranteed.

The API industry currently faces significant challenges including difficulty in scaling chemical production from a lab to commercial quantities. Developing new APIs can be lengthy and expensive. A compound must adhere to strict regulatory requirements which can be difficult when trying to maintain consistent batch-to-batch compound purity. Additionally, with roughly 70% of APIs derived from petrochemical feedstocks, the industry contributes 25% of pharmaceutical companies’ emissions, or close to 1% of global carbon emissions.

eXoZymes’ platform can currently achieve over a 95% compound purity, with the company having plans towards achieving 99.5%, reducing downstream purification requirements and potential drug side effects. The platform’s inherent design ensures that API manufacturers can transition their drug discovery findings from the lab into full commercial production effortlessly. The system's modular production capabilities allow API manufacturers to respond to fluctuating orders without overproducing or tying up extensive capital in inventory. Additionally, eXoZymes’ rapid chemical development timelines allow for faster regulatory filings, potentially delivering new drugs and life-saving therapies to patients sooner.

Scientific Report - Cannabinoid

Korman, Bowie and the team previously published two scientific reports demonstrating the platform's ability to synthesise a range of cannabinoid compounds.

Following on from its first study, in 2020 the team made further improvements to its Exozymes System, resulting in effective titres of 27.5 g/L of Cannabigerolic Acid (CBGA), nearly seven times higher than yeast-based cannabinoid synthesis methods (3-4 g/L). The platform used just 12 Exozymes and low-cost feedstocks and was also able to synthesise Cannabigerovarinic Acid (CBGVA).

Both CBGA and CBGVA serve as precursor compounds for producing Tetrahydrocannabinol (THC), Cannabidiol (CBD), Cannabichromene (CBC), Tetrahydrocannabivarin (THCV) as well as the hundred additional rare phytocannabinoids with diverse biological properties.

Uniquely, eXoZymes Inc. can synthesise entirely new-to-nature cannabinoids by making engineered optimisations to its Exozymes. These novel variant compounds could feature distinct molecular structures and ring configurations, potentially unlocking new medicinal benefits for cannabinoid-based therapies.

eXoZymes previously reported that its platform could produce a kilogram of cannabinoids for under $10,000, with a roadmap to reduce production costs to under $1,000. By contrast, current market prices for difficult-to-extract cannabinoids typically range from $ 25,000 to $50,000 per kilogram.

THC Bulk Manufacturer License

Since 2022, eXoZymes Inc. has held a bulk manufacturer license for the Schedule 1 controlled substance Tetrahydrocannabinol (THC), allowing the company to produce and sell THC in large quantities after meeting stringent legal and regulatory requirements. The global cannabinoid market is currently valued at $47 billion and is estimated to grow to $101 billion by 2029.

Energy Transition/BioFuels

TAM: $167 Billion

Biofuels are low-carbon liquid fuels and blending compounds derived from organic materials, including plant biomass, agricultural waste and algae. One of the most commonly used biofuels is ethanol, which is derived from plant starches and sugars and is blended in E10 (10% ethanol, 90% gasoline) vehicle fuel. Biofuels have lower carbon emissions throughout their cultivation, processing and combustion lifecycle when compared to fossil fuels, as well as generally producing fewer sulphur oxide pollutants when used.

Isobutanol

An emerging biofuel which is garnering significant interest is Isobutanol, an isomer of n-butanol, which is produced from similar feedstocks as ethanol. Isobutanol has an energy density of 33 MJ/L, similar to gasoline's 34 MJ/L and significantly higher than ethanol's 23 MJ/L. Additionally, this advanced biofuel is less corrosive than ethanol and can be readily used in existing combustion engines and piping distribution infrastructure.

Isobutanol is currently used in Bu16 (16% butanol, 84% gasoline) fuels and qualifies as a renewable fuel, which is defined as having a 20% lifecycle greenhouse gas reduction.

An emerging application of Isobutanol is its use in Sustainable Aviation Fuel (SAF). Currently, the aviation industry contributes 2% to global carbon dioxide emissions and the International Air Transport Association (IATA) has set ambitious targets to achieve zero carbon emissions by 2050. Central to IATA’s goal is the use of SAF, which is a low-carbon aviation fuel alternative made from sustainable feedstocks and production methods.

Alongside the IATA’s target, Europe has mandated that all European-based aviation companies are required to use up to 70% SAF in their jet fuel by 2050, a significant target given that only 0.2% of SAF is currently used. Similarly, in the US, there is growing support to increase SAF usage, with both state and federal governments offering numerous grant opportunities.

Yet, current Isobutanol production methods face several challenges, including difficulties in achieving high yields and titres when biomanufacturing the chemical compound at industrial scale levels. Higher production costs compared to fossil fuels also limit Isobutanol’s economic competitiveness and thereby market adoption. Additionally, cell-based platforms face significant cellular toxicity issues associated with microbial fermentation.

Scientific Report - Isobutanol

In 2020, Korman, Bowie and the team released a scientific report demonstrating that the company’s platform could synthesise Isobutanol from glucose via a 16-enzymatic pathway. The study achieved a productivity of 4 g/L per hour, a titre of 275 g/L and with the Exozyme System yielded 95% over 5 days. These results expanded upon the results from their 2017 study.

At the time, the gold standard for sugar to ethanol production was a productivity of 2g/L, a titre of 100g/L and a yield of 90%. The best reported metrics for microbial Isobutanol production were a productivity of 0.7 g/L, a titre of 22 g/L and a yield of 86% from E. coli. The results achieved by eXoZymes highlighted the company's considerable advantage in synthesising Isobutanol over other best-in-class biomanufacturing methods.

The company is currently collaborating with the DOE’s National Renewable Energy Laboratory (NREL) division to expedite the commercialisation of its Isobutanol Exozyme System. Recently, eXoZymes also received a $2 million grant from the DOD’s BioMADE initiative, which further supports the continued development of its Isobutanol system.

Considerations Scientific Reports

It is worth noting that the presented scientific reports were released several years ago. Since then, eXoZymes Inc. has further improved the performance of its Exozymes System with the support of:

Enhanced database screening of enzyme candidates to be engineered into Exozymes.

AI/Machine learning integration leading to further optimised Exozymes characteristics and biocatalysis performance.

Integration of recent Nobel Prize in Chemistry Award tools further optimising the platform's performance.

Future Market Applications

Food Flavours, Fragrances and Cosmetics

TAM: $71 billion

Food Flavors Industry: Compounds which enhance culinary sensations such as esters, aldehydes, ketones, terpenes and lactones that mimic natural tastes like fruit, spices, meat, or preservatives. The global food flavours market is valued at $19 billion.

Fragrances Industry: Mixtures of aromatic chemicals, essential oils and fixatives that craft vibrant sensory profiles such as citrus scents, floral essences and spice layers. The global fragrances market is valued at $62 billion and the industry supplying these compounds is valued at $17 billion.

Cosmetics: Beauty and care compounds such as emollients, emulsifiers, surfactants, preservatives, pigments and bioactive ingredients.. Applications can include anti-ageing serums, moisturisers, foundations, lipsticks and hair treatments. The global cosmetics market is valued at $296 billion, with the industry supplying these compounds valued at $35 billion.

Industrial & Specialty Chemicals

TAM: Likely reaching trillions of dollars

Industrial chemicals: These compounds comprise a wide range of foundational chemicals which are used in large-scale manufacturing and industrial processes, such as acids, solvents and petrochemical derivatives. These chemicals often serve as the raw materials or intermediates for producing plastics, fertilisers, detergents, paints and fuels. The industrial chemicals industry produces significant quantities of chemicals, often reaching millions of tonnes per year.

Specialty chemicals: These chemical compounds are produced in smaller quantities and tailored for specific, performance-driven applications. These compounds can include adhesives, catalysts, coatings, construction chemicals, electronic chemicals, industrial cleaning agents and water treatment chemicals.

eXoZymes’ Market Leadership

As the first and only company currently operating in the Exozyme-based biomanufacturing space, eXoZymes Inc. has strategically established a robust intellectual property portfolio following decades of platform research and development. Leveraging its first-mover advantage, the company has secured numerous patents related to the core innovations in cell-free enzyme stability, cofactor management and metabolic efficiency.

The company also safeguards numerous trade secrets, of which only Korman, Opgenorth and Bowie, the company’s co-founding scientists, know the details of. This level of discretion makes reverse-engineering the company’s platform extremely difficult, requiring years of research and extensive funding to achieve.

eXoZymes plans to further strengthen its market leadership position through securing additional patents via the support of MDB Capital’s highly regarded PatentVest team. These may include:

The development of entirely new compounds not found in nature or achievable via current biomanufacturing methods. As these small chemical compounds are verifiably novel, the company could seek patent protection.

The company’s Exozymes which have been genetically engineered for optimal biocatalysis performance. These altered proteins become unique innovations that may be eligible for patent protection.

The uniquely developed modular pathways for chemical synthesis. As these pathways are not found in nature, and therefore verifiably unique, the company could seek patent protection.

Further developments in the company’s Exozyme Systems and biomanufacturing platform. These continual advancements could present an opportunity for patent protection.

Competing Technology Platforms

As previously detailed, eXoZymes Inc. is currently the only company focused on Exozyme-based biomanufacturing methods. However, the biomanufacturing sector is dynamic, with new entrants and advancing technologies constantly emerging. Additionally, there are numerous established companies, while not directly replicating eXoZymes’ approach, compete in the same markets however, they use Synthetic Biology approaches. These include, but are not limited to:

Ginkgo Bioworks: Engineers microbes for a wide range of Synbio applications.

Codexis: Optimises enzymes for similar industrial applications through directed evolution.

Amyris: Produces bio-based ingredients using fermentation and engineered microorganisms.

Cascade Bio: Enhances enzyme performance with cell-free biocatalysts (Not Exozymes)

Arzeda: Designs novel proteins and enzymes via Computational and AI models.

Gevo: Focuses on sustainable biofuels through whole-cell biocatalysis processes.

Collaborative Alliances

MDB Capital’s Deep Tech Vetting Process

eXoZymes Inc. has been further validated through MDB Capital’s rigorous Big Tech assessment completed in 2019. This comprehensive due diligence process included, but was not limited to:

Intellectual Property

Evaluated eXoZymes’ patents and UCLA-licensed agreements, analysing the related market landscape to identify competitors, trends and infringement risks. MDB also explored avenues to reinforce existing patents as well as develop further patent opportunities.

Gauged the IP portfolio’s economic potential, focusing on market opportunity, patent life, and claim robustness to ensure a defensible leadership position.

Technology Leadership

Validated the technical feasibility of eXoZymes’ platform, consulting field experts and scrutinising the data. MDB’s iterative questioning ensured claims were held under scrutiny.

Analysed competitors to confirm eXoZymes’ differentiation, establishing a competitive moat and potential to lead high-value market applications such as pharmaceuticals and biofuels.

Business Model

Assessed eXoZymes’ go-to-market strategy, defining customer segments, refining sales and marketing approaches and identifying partnerships to support market entry and expansion.

Recruited commercial management team members, selecting professionals with extensive experience, specialised expertise and a proven track record of success.

Evaluated regulatory challenges, including grant funding dynamics and potential FDA pathways.

Financial Analysis

Analysed eXoZymes’ addressable markets in the context of scalability and commercial readiness, aligning market sizing with near-term and long-term monetisation strategies.

Stress-tested financial forecasts, focusing on revenue drivers, margin structure and capital efficiency across different growth scenarios.

Determined capital requirements tied to strategic inflection points, supporting funding strategy development and investor positioning.

Following this vetting process, MDB included eXoZymes into the company’s unique incubator program. With over 27 years of experience, MDB has launched 17 IPOs, with notable successes like Medivation being acquired by Pfizer for $14 billion.

GCxN Program

In October 2023, eXoZymes Inc. was accepted into Shell’s highly regarded GameChanger Accelerator Program, which is supported by the US Department of Energy’s NREL division.

Renowned for its rigorous selection process, the GCxN Program grants eXoZymes Inc. access to NREL’s world-class resources, including $250,000 in non-dilutive funding, expert business mentorship and opportunities for real-world large-scale pilot plant testing. Acceptance into the program further validates the significance of eXoZymes’ Isobutanol project but also underscores the impact that this platform can have on the global energy sector.

Exozyme’s strategic collaboration with NREL focuses on fast-tracking the commercialisation of its Isobutanol Exozyme System and centres on the delivery of several initiatives including:

A comprehensive techno-economic analysis to validate the company’s Exozyme production and biocatalysis models (Example Report).

A life cycle assessment to quantify the system's Isobutanol carbon reduction benefits (Example Report).

Identify a range of efficient and cost-effective biomanufacturing methods necessary for the company’s Isobutanol Exozyme System.

NREL’s reports will provide further credibility and validation for prospective joint venture partners towards the company’s Isobutanol project. These reports are expected to be released sometime in 2025.

Management Team

Michael Heltzen, CEO: A seasoned Biotech entrepreneur with over 20 years of experience. Heltzen has a proven track record of leading startups and established companies. He has held key leadership positions at EXO Incubator, BlueSEQ Innovations Inc., Cardea Bio and BGI Europe, which have provided Heltzen with a deep understanding of the biomanufacturing, synthetic biology and healthcare industries.

Tyler Korman, PhD., Co-Founder, VP of Research: A leading expert in molecular biology and biochemistry. Korman's technical understanding of cell-free enzyme-based systems stems from his doctoral and postdoctoral studies at UC Irvine and UCLA. Korman’s research, alongside Bowie and Opgenorth, led to the development of eXoZymes’ platform.

Paul Opgenorth, PhD., Co-Founder, VP of Development: Opgenorth is a leading specialist in metabolic engineering and bioprocess development with specific expertise in cell-free enzyme-based systems. His research has focused on developing efficient and cost-effective methods for synthetically producing biochemicals. Opgenorth was instrumental in developing eXoZymes’ platform alongside Korman and Bowie.

Damien Perriman, Chief Commercial Officer: Perriman is a Biotech industry veteran with more than 25 years of experience in developing and commercialising biotechnology platforms. Having held senior roles at Genomatica and Gevo, Perriman has successfully launched bio-based products like nutrition, cosmetics, textiles and performance fuels. Perriman’s extensive network and strategic business development experience support eXoZymes in securing high-value deals that strengthen the company’s path to commercial success.

Zachary Karl, PhD., VP of Business Development: Karl is a highly accomplished business development executive with extensive experience in the life sciences sector. As the former Director of Business Development at Ginkgo Bioworks, Karl reached out to join eXoZymes Inc. after recognising the significance of eXoZymes’ potential. Karl brings invaluable experience in strategic partnerships and a wealth of network connections to expedite the company’s commercial plans.

James Bowie, PhD., Co-Founder, Board Member: A globally renowned figure in molecular biology and Biotechnology, Bowie's pioneering work in synthetic biochemistry has fundamentally changed how scientists approach biomanufacturing. Bowie's lab at UCLA led to the development of eXoZymes’ platform. Bowie continues to provide valuable guidance to eXoZymes, ensuring the company remains at the forefront of cell-free Exozyme-based biomanufacturing methods.

James Lalonde, PhD., Board Member: Lalonde is a highly influential figure in the synthetic biology field, with a 40+ year career in drug development and enzyme engineering. Lalonde has held a leadership position at Amgen, where he oversaw R&D and the launch of numerous pharmaceuticals. After reviewing eXoZymes’ research, Lalonde was so impressed that he contacted the team to express his desire to support the company's groundbreaking work.

Financial Snapshot

eXoZymes Inc. is starting its transition from startup to early commercial deployment. During 2024, the company had no operating income and a total net loss of $5.86 million. For Q1 2025, the company had a net loss of $1.85 million. As of the 31st of March, 2025, the company had a cash balance of $8.51 million.

With the recent launch of its first subsidiary and its first joint venture partnership expected later in the year, eXoZymes is beginning its exciting platform deployment period, expecting to attract significant capital and generate revenues in 2025.

Notably, eXoZymes has operated with extreme capital efficiency during its pre-IPO development period. Net losses included $2.0 million (2023), $1.4 million (2022) and $1.21 million (2021).

Since its initial development journey from UCLA, eXoZymes has received $16 million in federal grants and $5.9 million in private investment from MDB Capitals co-founders. eXoZymes plans to strategically target additional government grants with the support of the US DOE’s NREL division.

On the 13th of November 2024, eXoZymes Inc. (formerly Invizyne Technologies) successfully listed on the Nasdaq exchange. The company raised $15 million at $8 per share.

Capital Structure

* Shares Outstanding: 8,367,810

* Stock Options, RSU’s, Warrants etc: 2,523,982

Risk Considerations

Resources

* eXoZymes has only recently begun to build its marketing presence, where previously most of the company's engagements were through its LinkedIn profile.

Disclaimer: Slack Capital is currently a shareholder of eXoZymes Inc. and therefore has a vested interest in its success. Slack Capital was not compensated in any form by the company to create this Company Report.

Slack Capital’s opinions are not investment recommendations and should not be relied upon for decisions. Information may be incomplete or subject to change. Investors should conduct their research and consult a qualified adviser.

Investments carry risks, and past performance does not guarantee future results. Slack Capital is not liable for financial losses based on this material. This content is not an offer or solicitation to buy or sell securities. Readers should verify information independently before acting.

Thanks for the effort you put into this article. I think, you found the next multibagger. The potential is incredible...

Extremely compelling company. Joined the discord. Thank you for the detailed write up.

What are your thoughts on MDBH? Market cap 36M now, holding around 60M in EXOZ stock and 17M in cash with an "intangible" asset being their hit rate and record (obviously past performance doesn't guarantee future performance).