eXoZymes - Snapshot Investment Case

The following post is a concise version of my extensive investment report on eXoZymes.

EXTENSIVE INVESTMENT REPORT ON EXOZYMES

eXoZymes Snapshot

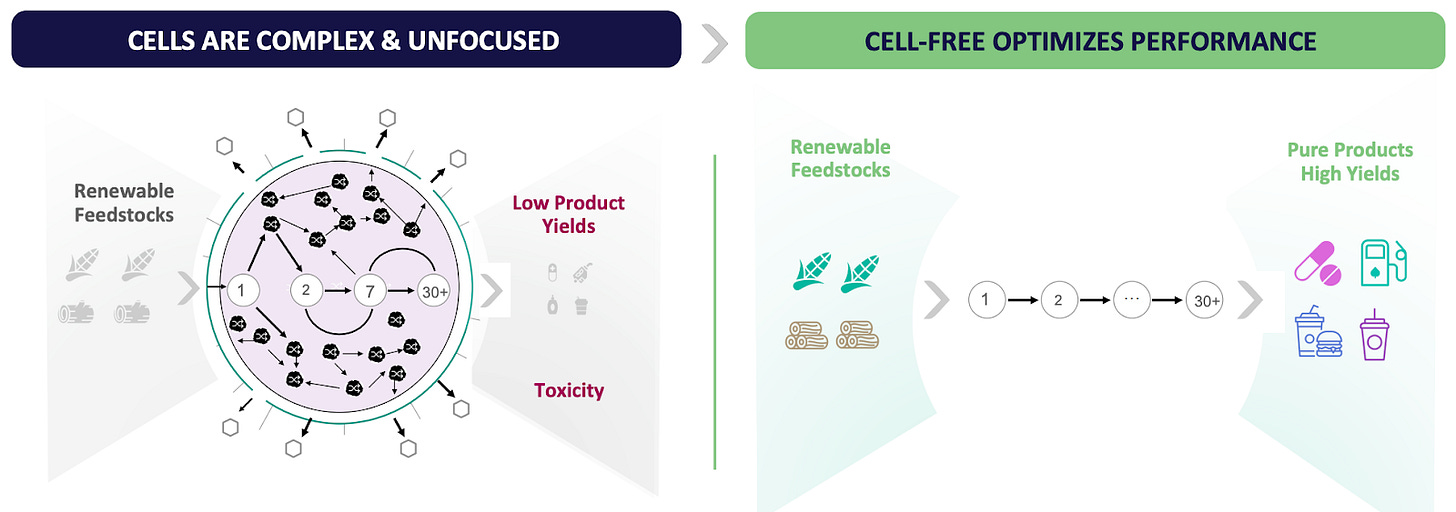

eXoZymes Inc. (NASDAQ: EXOZ) is a biomanufacturing technology company that has developed an advanced ‘cell-free’ biomanufacturing platform. After a decade of R&D, the company is now transitioning from technology development to commercial deployment, targeting the production of compounds with multi-billion-dollar market potential.

eXoZymes has innovated an entirely new method of making chemicals by taking enzymes, the ‘molecular workers’ inside cells, and engineering them to operate outside a cell. This first-of-its-kind, exclusively patented ‘cell-free’ approach overcomes the significant limitations of cell-based methods, such as low production yields, difficulty in scaling and slow R&D cycles.

The company combines its proprietary enzymes, cofactors and reagents in precisely engineered pathways, converting feedstocks like glucose into high-value chemicals within relatively standard bioreactor infrastructure. Each biological input and bioreactor condition (pH, temperature, etc.) is optimised for peak performance, and eXoZymes has repeatedly demonstrated the effectiveness of its platform with a recent compound achieving a 96% production yield with a 99% purity.

The platform’s biochemical processing capabilities enable the production of difficult-to-extract natural compounds as well as entirely new-to-nature molecules, where minor changes to conversion pathways can lead to completely different outcomes. This ability unlocks significant commercial opportunities, enabling the development of high-value compounds for partners, particularly in the nutraceutical and pharmaceutical sectors.

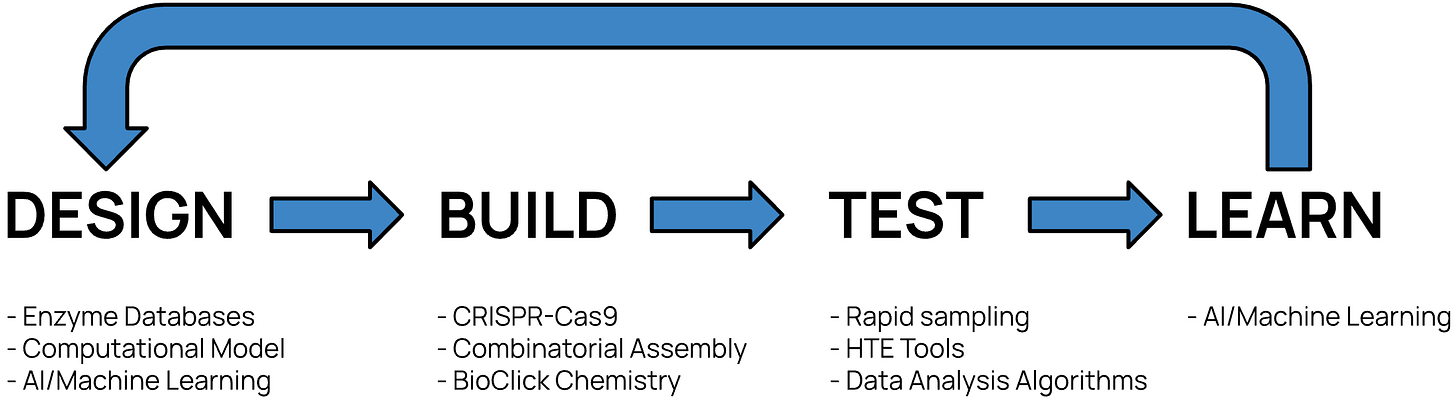

Next-Generation DBTL Cycle

In addition, eXoZymes holds an industry-leading advantage with its rapid Design–Build–Test–Learn (DBTL) cycle, integrating AI, computational protein design and high-throughput experimentation to run hundreds of automated experiments in parallel, reducing R&D efforts from years to weeks and significantly reducing compound development costs.

As the platform functions like a controlled chemical reaction with no cell-based components, each DBTL cycle generates extensive datasets that continuously feed eXoZymes’ AI model. As this data accumulates, it drives a feedback loop that iteratively improves the platform’s performance.

As a result, eXoZymes has demonstrated over 80% enzyme stability gains within 3 weeks, compared to just 20% over 4 months using traditional methods. Enzyme activity can also be increased 4x over 3 weeks, while cycle time can be reduced from 5 days to just 2. This proprietary system significantly enhances the company’s biomanufacturing capabilities, increases production titres and yields, and improves the overall economic viability of a compound’s production.

Unlocking Real World Applications

NCT is among the first publicly disclosed compounds in active development. Found in trace amounts (0.014%) within hemp seeds, NCT has remained commercially unavailable, despite its considerable nutraceutical and pharmaceutical potential. Preclinical data suggests NCT may help address fatty liver disease, a condition affecting 30% of the global population and representing a US $17.6B market with no existing therapeutic solutions. NCT has also been shown to support gut barrier function and mitochondrial activity, both representing substantial opportunities.

In an industry first, eXoZymes made 4 grams of pure NCT in a single production cycle. This compound progressed from ideation to lab validation in 6 weeks, followed by 5 months of consistent platform performance and development of a techno-encomic model, all at a fraction of typical SynBio R&D cost. For comparison, extracting the same amount of NCT would require 25kg of hemp seeds or ~1,600 plants.

eXoZymes is also developing NCT pharmaceutical analogues, aiming to boost the compound’s therapeutic efficacy and unlock even greater commercial potential. Building on this momentum, the company is preparing to scale its NCT production 100x over the coming months while actively engaging potential commercial partners.

Another compound that has been publicly disclosed is santalene, a high-value molecule with aromatic, medicinal and pharmaceutical applications. Santalene also occurs in trace amounts, making up 1–3% of sandalwood oil, which itself represents 3–6% of heartwood mass. eXoZymes preliminary R&D results are expected to be announced early next year.

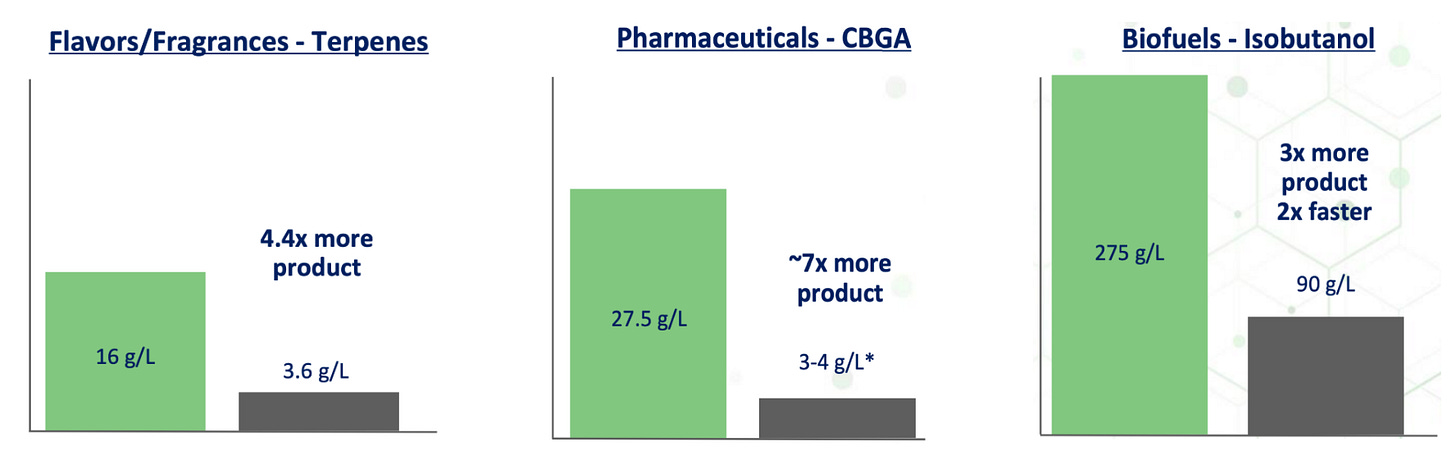

Beyond these compounds, eXoZymes has also demonstrated the platform’s production capabilities of Terpenes (2017), CBGA (2020) and Isobutanol (2020). Notably, these results were achieved years before the platform achieved significant performance improvements.

Together, these initial compounds highlight the transformative power of eXoZymes’ platform, capable of developing 100s of high-value compounds previously inaccessible, while drastically reducing R&D time and cost. This impact will only grow as the company’s proprietary DBTL cycle evolves and new technological advancements are integrated into the platform.

Commercial Strategy

Building on these groundbreaking results, eXoZymes is now moving from platform validation to active commercialisation, initially targeting high-value nutraceuticals with pharmaceutical potential, and extraordinary business cases (Isobutanol).

Nutraceutical and pharmaceutical compounds typically require relatively low production volumes, often just a few kilograms per year, while carrying significant commercial value. These volumes align with eXoZymes’ current manufacturing capabilities, enabling the company to extensively validate its platform at a smaller scale before before scaling production to hundreds of kilograms at partner-operated facilities.

At its core, eXoZymes is a R&D company and does not intend to operate large-scale production facilities, which require substantial capital investment and carry operational risk. Instead, the company intends to commercialise its technology through spin-outs, joint ventures and licensing agreements, partnering with organisations capable of scaling its manufacturing platform.

The platform’s capabilities have already attracted significant industry interest, with over 130 active engagements and 3 companies now in the final stages of negotiating commercial deals.

Spin-Outs

This occurs when eXoZymes identifies a compound with strong demand, premium pricing and limited supply, presenting a clear opportunity for its platform. The company then demonstrates viable compound production, establishes a wholly owned subsidiary and spins it out, selling a partial equity stake to a partner who will be responsible for global sales and distribution.

eXoZymes recently launched its first spin-out, NCTx, which holds ownership of its NCT compound.

Joint-Venture

Unlike spin-outs, where partners are brought in once a compound is approaching its maximum value, JVs involve partners earlier in the development cycle. This early collaboration accelerates commercialisation, spreads risk and can significantly enhance the compound’s overall value.

In April, eXoZymes indicated that its first JV could be signed later in the year, likely with a global leader in the nutraceutical/pharmaceutical sector.

Licensing Agreements

Following several successful compound launches through its platform, eXoZymes will start to license its IP, enabling external partners to integrate the technology directly into their chemical manufacturing operations.

The company will continue R&D on compound development and platform optimisation, while earning upfront and milestone payments as it achieves specific R&D goals. For example, in 2021, Ginkgo Bioworks received a $5 million upfront payment, with potential milestones up to $115 million through a collaboration with Biogen.

Once the platform is operational and the partner is producing the defined compound, eXoZymes may also earn royalty payments, typically 3–8% depending on the compound. This pick-and-shovel model is highly profitable, requiring minimal capital expenditure while delivering high profit margins, as demonstrated by companies like ARM Holdings (US $151B).

Market Applications

Nutraceutical Ingredients - TAM US $105 B

Compounds that provide a targeted blend of nutritional and health benefits, often extracted or synthesised from various plant-based feedstocks. A single compound can be frequently used across multiple products, providing attractive commercial deal opportunities.

Active Pharmaceutical Ingredients - TAM US $255 B

The bioactive compounds in pharmaceutical products responsible for the intended therapeutic effects. Requires ultra-pure compounds, which are later formulated into targeted final products.

Energy Transition/BioFuels - TAM US $167 B

Low-carbon liquid fuels and blending compounds produced from organic materials. eXoZymes’ initial focus in this market is Isobutanol, which has attracted considerable interest in the Sustainable Aviation Fuels sector.

Food Flavours, Fragrances and Cosmetic Ingredients - TAM US $71 B

Industrial & Specialty Chemicals - TAM likely reaching trillions of dollars

Supporting Investment Drivers:

The company holds a comprehensive patent portfolio and was the first to develop an Exozyme biomanufacturing platform, creating a strong barrier of entry for competitors.

Several undisclosed compounds are being actively developed, targeting multi-billion-dollar opportunities, particularly in the high-value nutraceutical and pharmaceutical sectors.

The company has secured numerous government grants, reflecting recognition of the platform’s strategic importance in advancing the US biotechnology sector.

High-profile industry executives have joined the team, reflecting confidence in the platform’s capabilities and increasing the likelihood of commercial success.

The company maintains a disciplined capital approach, prioritising high-impact projects and operational efficiency prior to scaling its platform.

Investment Opportunity

Shares in eXoZymes ($EXOZ) are tightly held, with founders, insiders and institutions holding over 68% of the stock. The company remains largely under the radar with low trading volume, even as its commercial pipeline rapidly advances. My extensive investment report is among the first major coverages of eXoZymes, highlighting a compelling investment opportunity.

Yet, it is important to recognise the market’s general hesitancy toward biotech and synthetic biology companies, given the industry’s history of unfulfilled promises that have resulted in significant investor losses. For example, Ginkgo Bioworks, once an industry leader, reached a US $27.3B valuation only to drop to US $650M.

However, eXoZymes clearly stands apart in the industry. Its platform already delivers near-theoretical yields and titres, and can meet the demand for nutraceutical and pharmaceutical compounds without the need for significant infrastructure scale-up. If the company accomplishes even a fraction of its vision, eXoZymes’ platform could usher in a new wave of global biochemical manufacturing, advancing both environmental sustainability and human well-being.

With a current market capitalisation of US $120 M, eXoZymes represents an asymmetric investment opportunity with significant re-rating potential on the horizon.

Resources

To learn more about eXoZymes, you can view my extensive investment report as well as listen to the following Interview with the SynBio industry’s largest podcast and recent company quarterly presentation

I have also established an eXoZymes Investor Discord group, which you can join via the following link.

James, excellent update and hopefully about happen. Deal announcements/etc. should light this one up and start the improvement in valuation that this company deserves. Keep up the good work you're going in this one. Rodney

James, thanks for all your work on $EXOZ! I find the technology quite fascinating, as a non-scientist. I asked Claude if there were any competitors working on cell-free synbio, and it pointed me to Debut Bioscience: https://www.debutbiotech.com/

They are privately held, and focused on an end-to-end manufacturing solution for the beauty industry, but the tech may have some parallels. It was spun out of Greg Weiss's lab at UC Irvine - is that where Tyler did his PhD? - and has funding from L'Oréal. Seems like a case of VC capital making people narrow their platform potential down a great deal... But I'm curious if you also came across them in your research, and have any sense of how the technology may overlap?