Northstar Clean Technologies: Leading the Charge in a Unique Market Opportunity

With its first commercial facility launching in June, Northstar is set for rapid expansion, leveraging its patented recycling platform to transform asphalt shingle waste into high-value materials.

To access this investment report as a PDF, please click the following link.

Please review Slack Capital’s Investment Disclaimer prior to reading this report.

Investment Overview

Northstar Clean Technologies (TSXV: ROOF) (OTCQB: ROOOF) is a Canadian-listed company focused on the recovery and reprocessing of asphalt shingles, a significant contributor of construction waste in North American landfills. The company has developed a patented process that recovers valuable materials from discarded asphalt shingles — liquid asphalt, aggregate, and fibre — that are then sold to industries that incorporate them into their manufacturing processes.

Collaborative support for the growing waste challenge

According to the U.S. Environmental Protection Agency, more than 16.5 million tons of shingles are discarded annually, making it one of the top five largest materials of construction waste in North America. Amid a global push to reduce waste and promote a circular economy, both the asphalt manufacturing industry and governments are uniting to find solutions that are not only sustainable but also economically viable.

Transforming pilot success to commercial impact

Northstar has successfully demonstrated its technology at its pilot plant in Vancouver, BC, where it refined operational processes to increase the likelihood of success at its next facility in Calgary. If the technology successfully transitions from pilot plant to commercial scale, Northstar intends to ‘copy and paste’ its facility design across multiple strategic locations, unlocking significant revenue potential and further solidifying its first-mover advantage in the market.

Driven by strong economic foundations

Northstar's facilities are built on strong economic foundations that are inherently conservative. With several potential growth factors deliberately excluded but highly likely to materialise, there is a significant opportunity to further enhance the financial performance of its operations. Additionally, the growing focus on ESG and increasing demand for recycling solutions will only seek to boost the economic outlook.

As Northstar Clean Technologies commissions its first commercial facility in Calgary, expected to be fully operational by June 2025, the company is poised to drive immediate value and potentially boost its share price by addressing the urgent need for sustainable asphalt shingle waste management solutions.

Asphalt Shingle Roofing Industry

Asphalt shingles are a popular roofing material made from a fibre base, coated with asphalt, and topped with aggregate granules. This combination makes asphalt shingles weather-resistant, durable, and cost-effective. Available in various colours and styles, they are widely used for their ease of installation and low maintenance.

The asphalt shingles industry dominates the North American roofing market, valued at approximately USD 7.31 billion and projected to grow at an annual rate of 3.7% through 2032. In the U.S., around 84% of single-family homes use asphalt shingles. In Canada, the figure is around 75%. Eight major asphalt shingle manufacturers dominate the industry.

Asphalt shingles typically have a lifespan of 15 to 30 years before requiring replacement. However, once discarded, the shingles present a significant environmental issue, as they can take up to 300 to 400 years to decompose in landfills. These shingles not only occupy valuable landfill space but also pose significant environmental risks. A study by the US Environmental Protection Agency found that asphalt shingles can leach harmful chemicals, including polycyclic aromatic hydrocarbons (PAHs), into the surrounding soil and water.

With few options for handling discarded shingles other than sending them to landfills, approximately 16.5 million tons of asphalt shingles are disposed of annually across North America, with most of this waste being sent to landfills in the U.S. and Canada, including around 1 million tons of scrap generated by shingle manufacturers. To put this in perspective, this volume of waste is equivalent to filling nearly 750,000 garbage trucks annually, making asphalt shingles the one of largest materials in construction and demolition waste in North America.

Currently, only 10% of asphalt shingles are recycled each year, with the main application being in road construction. However, in response to growing concerns, some regions have recently begun implementing bans or restrictions on the use of recycled asphalt shingles (RAS).

Asphalt Manufacturing Industry Recycling Ambitions

The Asphalt Roofing Manufacturers Association (ARMA), representing leading North American manufacturers, has set ambitious targets to reduce landfill disposal of asphalt-based roofing materials by 50% by 2035 and eliminate nearly all waste by 2050. Given that the current recycling rate for asphalt shingles is just 6% of the total waste generated each year, this goal is monumental.

Currently, no existing technology can effectively address this challenge, creating a significant market opportunity for companies like Northstar Clean Technologies. To meet ARMA's 50% reduction target by 2035, Northstar would need to build over 200 facilities, a strategy that will be explored in more detail later.

Challenges in Recycling Asphalt Shingles

Recycling asphalt shingles presents several technical challenges due to their complex composition and durability, including:

Separation Difficulty: The strong bond between asphalt and aggregate makes it challenging and time-consuming to separate these materials. Effective separation often requires advanced, specialised equipment, which adds both complexity and cost.

Quality Control: Ensuring that recycled asphalt meets the stringent specifications for high-quality paving. Unlike virgin asphalt, which is tightly controlled during production, recycled asphalt can show variability in its physical properties, making it difficult to meet the rigorous standards required for certain paving applications.

Shredding Issues: Shredding shingles in bulk is problematic due to the high concentration of granular materials, which act like abrasive sandpaper. This creates difficulties when moving, separating, or processing large volumes, leading to operational inefficiencies and increased wear on equipment, ultimately driving up costs.

Northstar Clean Technologies - Leading the Charge

Northstar Clean Technologies, a Canadian-based and dual-listed manufacturing cleantech company, is tackling the mounting waste issue by capturing and reprocessing discarded asphalt shingles, allowing them to be transformed into valuable materials for use in the manufacturing industry once again.

Through its innovative, patented Bitumen Extraction & Separation Technology (BEST), Northstar Clean Technologies efficiently separates asphalt shingles into their three core components—high-value liquid asphalt, aggregate, and fibres—achieving an impressive 99% yield. The high-value liquid asphalt derived from Northstar’s process is resold across a range of industries including road paving, asphalt shingle production, and hot-mix asphalt production. Meanwhile, the lower-value materials will be used within their respective industries.

The BEST patented process is specifically designed to handle the complex structure of asphalt shingles by integrating heat, mechanical separation, and chemical processes to break down shingles and efficiently separate their components. The process consists of 15 distinct stages, organised into 7 key phases, from start to finish:

Preparation: Shingles are sorted/cleaned to remove contaminants like nails and debris.

Shredding: The shingles are shredded into approximately 1-inch squares.

Water Separation: The shredded material is placed into a vessel where room-temperature water is applied. This high-pressure water primarily separates the aggregate from the shredded material.

Agitation and Separation: The mix is agitated, causing the sand to settle at the bottom while the oil and fibres float to the top. The sand is collected from the tank's bottom, and the water is recirculated for continuous use.

Dilution: The remaining oil and fibre mixture is transferred to a new tank where a solvent is added to thin the oil by mixing it with the diluent.

Pressing: The oil/solvent mixture is then squeezed out of the remaining fibre using screw presses.

Distillation: Finally, the oil/solvent mixture is passed through a distillation tower to separate the solvent from the oil, with the solvent then recirculated for reuse.

During 2022, Northstar operated and refined its asphalt shingle recycling process at its pilot plant in Delta, British Columbia, continuously fine-tuning the process to achieve optimal yields and maximise economic potential. In 2023 and 2024, the company used the facility for equipment manufacturing and testing as well as providing more samples to offtakers.

These efforts were further supported by the company’s partnership with BBA Engineering, a renowned firm with over 40 years of expertise in the Energy and Natural Resources sectors, which completed the independent engineering design of Northstar’s modular facility. With this strong foundation and the extensive groundwork laid, the company is well-positioned to successfully commission its first commercial-scale facility in Calgary. This is in addition to the extensive R&D and engineering contributions from McAsphalt and TAMKO.

Northstar also had its recovered liquid asphalt tested by an independent third-party laboratory, which confirmed that its quality and penetration rate met the acceptable standards for sale to end-user customers.

Diverse Revenue Streams

Each Northstar facility will generate revenue through multiple key channels, which together support the unit's strong financial viability which will be showcased later in the report.

Tipping Fees

Representing 36% of a facility's revenue stream (with a near 100% profit margin), Northstar charges tipping fees to those who offload asphalt shingle waste at their facilities, positioning the company as both a waste management provider and a recycling manufacturer. Clients who drop off discarded shingles include shingle manufacturers, construction and demolition companies, homeowners, waste management firms, and, crucially, municipal governments that divert asphalt shingles from local waste collection facilities to Northstar's locations.

Tipping fee prices charged will vary depending on the location of each facility. For instance, in Calgary, it currently costs CAD 113 per tonne to dispose of asphalt shingles at the municipal landfill whereas in Vancouver it costs CAD 150 per tonne. As landfill capacity continues to diminish, tipping fees are expected to keep rising, having already increased by 25.5% since January 2016. To encourage drop-offs at Northstar facilities, the company will offer a discounted tipping fee, such as CAD 85 per tonne in Calgary, representing a 25% savings compared to the municipal rate.

To ensure a consistent supply of shingles at each facility, Northstar Clean Technologies will arrange feedstock agreements with key partners, such as Ecco Recycling, which will supply 20,000 tonnes of shingle waste annually to Northstar’s Calgary facility.

While construction and demolition companies may contribute a smaller share of shingle feedstock compared to diversion agreements, Northstar's facilities provide a key advantage in terms of time efficiency. Drop-offs at district landfill sites often involve long wait times due to mixed waste processing and heavy truck traffic. In contrast, Northstar’s streamlined process reduces unloading times, making it a more time-effective option, even if it’s located slightly farther away.

Liquid Asphalt Sales

Revenue from liquid asphalt produced at Northstar facilities accounts for approximately 61% of the total projected income per facility. Northstar has conservatively projected a price of CAD 650 per tonne for liquid asphalt, while current industry prices range between CAD 700 and 1,100 per tonne.

Although the prices of Northstar's offtake agreements with McAsphalt and TAMKO are not publicly disclosed, they are expected to be index-based, with final pricing adjusted for factors such as location and quality variations. Additionally, there is further price upside, as Northstar’s liquid asphalt is likely to command a premium due to its strong ESG attributes.

Following Northstar’s extensive groundwork from their pilot plant in 2022, the company has sent samples of their liquid asphalt to several potential offtake companies. These companies have assessed its integration into their manufacturing processes and provided highly positive feedback.

Aggregate Sales

The aggregate, mainly composed of sand and small stones, contributes a smaller share of a facility's revenue. It will be sold to regional construction, paving and landscaping companies.

Fibre Sales

Extracted fibre will also be sold regionally, most likely to concrete manufacturers. Historically, asphalt shingles used cellulose (paper) for their fibre content, but the industry has recently shifted to using fibreglass mats for their superior performance properties.

Carbon Credits (Untapped potential)

Northstar's Life Cycle Assessment report highlights that its shingle recycling process reduces carbon emissions by 60% compared to traditional asphalt disposal and virgin asphalt production. This translates into a savings of 117.49 kg of CO2 per tonne of feedstock, roughly equivalent to the emissions from driving a gasoline car for 500 km.

To earn carbon credits, Northstar must have its carbon reductions officially verified. The verification process is expected to be completed by early 2027, 18 months after commissioning concludes in Calgary. Each of Northstar’s shingle recycling facilities will require its own carbon credit verification as the associated metrics (transportation, facility energy generation) will be different. However, once Calgary’s assessment criteria are approved, the verification model will have its inputs altered per facility.

Ultimately depending on the justification in which a facility is located, Northstar can generate the following types of carbon credits:

Verified Carbon Units (VCUs): These are issued for projects that undergo third-party verification (Verra) and can be traded on voluntary carbon markets.

Compliance Credits: In jurisdictions with mandatory carbon reduction programs, such as cap-and-trade systems, Northstar could generate compliance credits. Regulated entities can use these to meet emission reduction targets.

Tax Credits: In certain jurisdictions, Northstar may qualify for tax credits as an incentive for reducing emissions. These credits can offset tax liabilities.

While carbon credits are not currently included in Northstar's financial models, they present an untapped opportunity to boost the company's financial performance, depending on the jurisdiction where the credits are generated.

Assessing the potential revenue generation for Carbon credit, the company could generate up to CAD 400,000 per facility however once again this ultimately depends on the jurisdiction and their associated carbon credits program.

Facility Economics

Each Northstar Clean Technology facility will have its own distinct economic profile shaped by factors such as regional market conditions, supply chains, and offtake agreements. The company has shared detailed financial projections for its Calgary plant, which serves as a benchmark for evaluating the potential performance of future facilities.

Estimated Initial Capex

The initial capital expenditure for the Calgary facility is projected at CAD 17.5 million, inclusive of a 20% contingency. Based on insights gained from Calgary’s construction process, management anticipates that future facilities will require a lower CAPEX, estimated at approximately CAD 15 million.

The rise in CAPEX expenditure from 2022 to 2023 was driven by improvements to Calgary’s operational processes, informed by insights gained at the Pilot Plant facility in Delta and feedback from offtake clients.

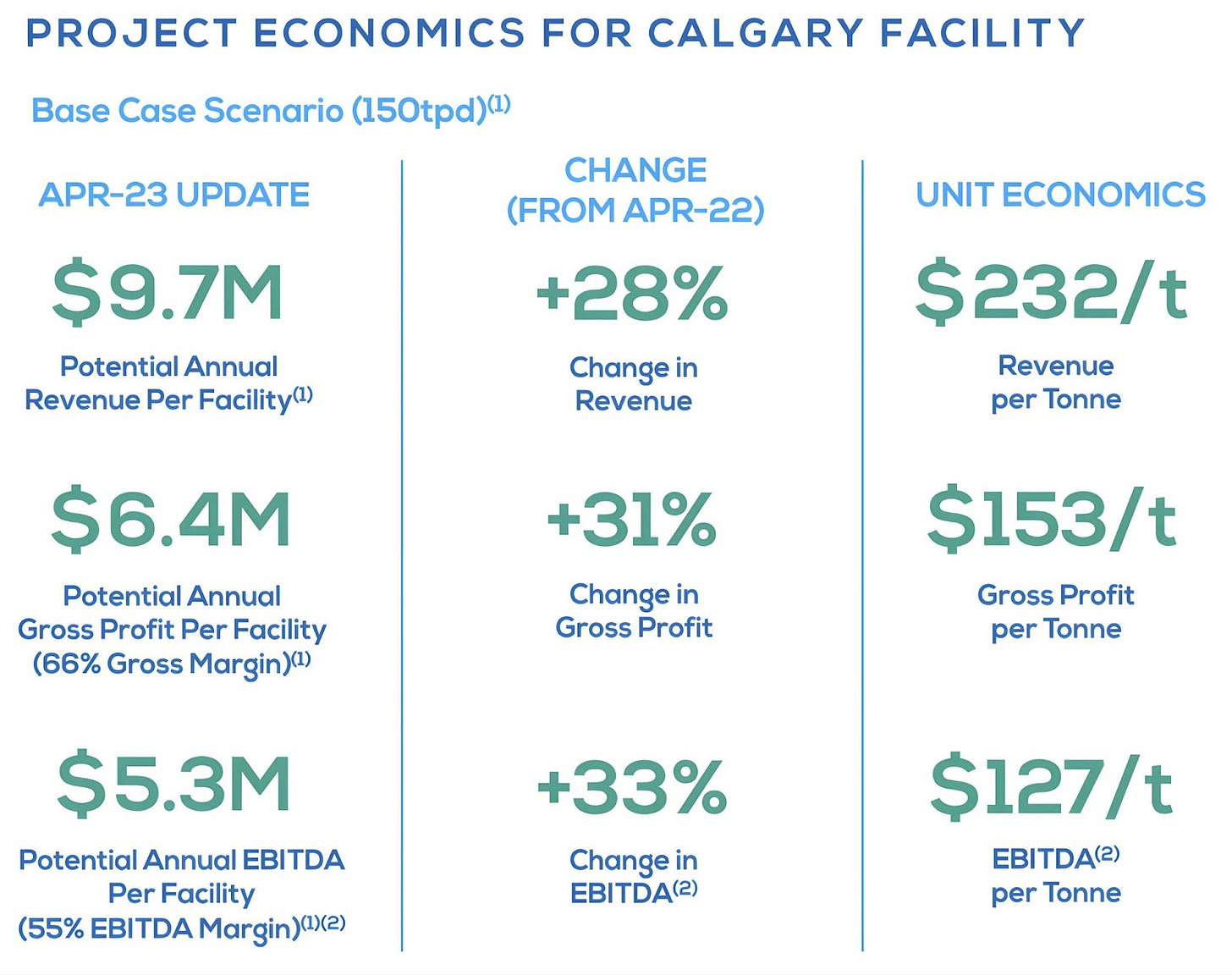

Calgary’s Annual Financial Projections

The Calgary facility's economic model is based on processing 150 tonnes of asphalt shingles per day, operating 10 hours a day for 24 days each month. Northstar has also adopted a conservative estimate of CAD 650 per tonne for liquid asphalt.

It’s important to note that Calgary’s financial projections are intentionally conservative, with the sensitivity analysis on the following page clearly showing the significant upside potential that management believes is achievable.

Increasing TPD Processing Capacity: With improved access to feedstock and operational efficiencies, the facility has the potential to scale its processing capacity from 150 TPD to 200 tpd. This would raise IRR from 31% to 39.9%.

Expanding to 24-Hour Operations: Northstar plans to expand operations at their Calgary facility to a 20-hour schedule, divided into two 10-hour shifts, compared to the currently modelled one 10-hour day. This adjustment is projected to increase the IRR from 31% to 36.6%.

Market Price Fluctuations: The liquid asphalt price is conservatively set at CAD 650 per tonne, while the actual market price can vary between CAD 700 and 1,000 per tonne depending on the location. If Northstar sells its asphalt at CAD 800 (+CAD 150) this would boost its IRR from 31% to 36.5%.

Implementing these three core changes would increase Northstar's Project After-tax IRR from 31% to 51%.

Northstar Facilities

Pilot Plant - Vancouver

Northstar’s Pilot Facility, located in Delta, British Columbia, is strategically positioned just a 10-minute drive from the Metro Vancouver landfill. Currently operating as a proof-of-concept pilot plant site since 2022, the facility has been processing asphalt shingles and distributing recycled material samples to numerous multi-billion-dollar offtake companies which has already secured them offtake agreements with TAMKO and McAsphalt.

Leveraging their well-equipped R&D teams, these companies have thoroughly assessed Northstar’s outputs, providing overwhelmingly positive feedback and confirming that the recycled materials meet industry standards, similar to the validation provided by an independent third party.

Commercial Launch - Calgary

Northstar’s Calgary facility marks a pivotal step as the company’s first full-scale commercial plant, strategically located just 4 km from the City of Calgary’s Southeast Landfill.

The facility is nearing full completion, with all major equipment installed and mechanical work almost finalised. Once completed, the facility will enter its commissioning phase, which is expected to continue through June 2025. During this time, operations will gradually scale up to reach a full production capacity of 41,400 tonnes per year, with a stockpile of feedstock already prepared for processing. It is expected that by 2025, the facility will process 20,000 tonnes.

Successful operations will not only validate the technology at a commercial scale but also provide a blueprint for replication at future sites, driving the company’s expansion. The Calgary plant has also attracted significant interest from potential clients and local governments eager to evaluate its outcomes.

Calgary Feedstock Agreements

IKO: Northstar has secured a 5-year feedstock agreement with IKO to supply an undisclosed amount of asphalt shingles annually. Previous estimates suggest this could range between 10,000 and 12,000 tonnes per annum.

Ecco Recycling: A 3-year contract has been signed that will supply 20,000 tonnes annually to Northstar’s Calgary facility.

Additionally, Ecco Recycling currently has a waste stockpile of over 500,000 tonnes of shingles located near a planned train station. Both companies will jointly evaluate this stockpile's compatibility with Northstar's BEST technology once the Calgary facility is operational.

Municipal Engagement: Discussions are ongoing with the City of Calgary to divert asphalt shingles from landfills to Northstar's facility, reinforcing a reliable feedstock supply chain.

The total feedstock expected from these three partners is expected to be up to 50,000 tonnes per annum. This does not include Ecco’s stockpile.

This feedstock supply does not include material dropped off by construction and demolition companies, which are expected to contribute a reasonable volume of feedstock.

Offtake Agreements

Northstar has secured a 5-year long-term agreement with McAsphalt Industries, Canada’s largest asphalt distributor and a subsidiary of Colas Canada. Under this agreement, McAsphalt will purchase 100% of the liquid asphalt produced, ensuring a stable and predictable revenue stream while reinforcing Northstar’s position as a trusted partner in the asphalt industry. The price of liquid asphalt is based on market rates; however, Northstar has incorporated a risk management mechanism to establish a floor price above the facility's cash flow break-even point.

2026 Expansion Plans

Given the significance of the markets for the next three facilities, there is the potential for each facility to scale to 80,000 tonnes per annum within 6 months of operations.

Northstar's Next Growth Hub - Hamilton, Ontario

Northstar Clean Technologies is advancing plans for its next facility in Hamilton, Ontario, with construction and commissioning targeted for 2026. Hamilton has been identified as a strategic location due to its abundant feedstock supply and proximity to key offtake clients in the Greater Toronto Area (GTA). Northstar has stated there is the potential to establish up to three or four facilities in the region over time, capitalising on its favourable market conditions.

Northstar has recently secured a site in Hamilton, allowing progress on key steps such as federal and provincial grant applications, permitting, and negotiations for feedstock supply and offtake agreements. The region also offers significant economic advantages, including a tipping fee of CAD 121 in Toronto, which is more favourable than the tipping fees in Calgary.

Notably, IKO operates a large asphalt shingle manufacturing facility in Brampton, Ontario, and already has a feedstock agreement with Northstar for their Calgary facility. This existing partnership positions IKO as a potential feedstock supplier for Northstar’s future Hamilton facility. Additionally, Building Products of Canada, now owned by Saint-Gobain, operates an asphalt shingle manufacturing plant in Sarnia, Ontario, which could also supply feedstock.

Strategic Retrofit for Growth - Vancouver

With Vancouver's tipping fees at CAD 150 per tonne, the highest in Canada, Northstar Clean Technologies sees a substantial market opportunity in the region. Management plans to retrofit the existing Delta facility to take advantage of the region's attractive economics. With most permits already in place and the site already established, this presents a compelling expansion option.

Northstar is currently engaging in discussions with feedstock suppliers, offtake clients, and the municipal government, which enforces some of Canada’s strictest ESG regulations.

Located on the US-Canada border, IKO also has a manufacturing facility in Sumas, Washington. As previously stated, Northstar already has a feedstock agreement with IKO for their Calgary facility.

Northstar’s First U.S. Facility in the Mid-Atlantic Region

In 2026, Northstar plans to establish its first U.S. facility in the Mid-Atlantic region, supported by its strategic MOU agreement with TAMKO Building Products. Under this agreement, Northstar may provide asphalt shingle material feedstock to TAMKO’s production facility in Frederick, Maryland at market-based pricing. The two companies have been working closely to identify the ideal location within the Mid-Atlantic, which spans Maryland, Delaware, Pennsylvania, New Jersey, New York, and portions of Virginia and West Virginia.

The average tipping fees in the Mid-Atlantic region are USD 75.92 (approximately CAD 109), presenting an attractive and strategic opportunity for Northstar's expansion.

Additional asphalt shingle manufacturing plants in the region include IKO having a manufacturing plant in Hagerstown, Maryland. Once again, Northstar already has a feedstock agreement with IKO for their Calgary facility. Additionally, Owens Corning and Malarkey Roofing Products both have manufacturing plants in Maryland.

Path to Expansion: Northstar’s Future Facility Locations

Featured on slide 23 of Northstar's Investor Presentation, the company highlights three potential U.S. locations including a facility near Dallas Texas, Chattanooga Tennessee, and Springfield Missouri. While specific details are limited, these sites are likely candidates for expansion in 2027, given their strategic proximity to TAMKO manufacturing facilities.

Choosing future facility locations involves a thorough evaluation of key factors that are critical to financial and operational success. These include but are not limited to:

A minimum regional population of 1 million inhabitants

Regional tipping fee prices

Regional liquid asphalt prices

Location of asphalt shingle feedstock suppliers and offtakers

Transportation logistics

Proximity to existing landfills

Local waste diversion policies

Environmental Policies

Permitting requirements

Government support for sustainability initiatives

Corporate Tax Rates

Beyond their first commercial facility in Calgary, Northstar has outlined that bringing a new facility into full-scale production would require approximately 18 months for permitting, 4 months for construction, and 1 month for commissioning. With an aggressive growth strategy, the company aims to construct 3 new facilities annually starting in 2026.

To this end, Northstar has already internally identified its top 10 locations, prioritising regions with favourable economic conditions, including high tipping fees, high liquid asphalt prices and a strong likelihood of securing up to 82,800 tonnes of feedstock annually. Since the CAPEX for Northstar's facilities remains roughly CAD 15 million regardless of whether they process 41,400 tonnes or 82,800 tonnes per year, it is more capital-efficient to prioritise locations with a higher likelihood of securing larger feedstock supplies.

Leveraging its first-mover advantage with the current absence of any major competitor, Northstar is uniquely positioned to select the most optimal locations for securing feedstock and offtake agreements and municipal waste diversion partnerships. If the company can swiftly construct these 10 facilities, Northstar stands to establish a dominant market position and potentially secure a monopoly on asphalt shingle recycling in these regions.

Licensing Opportunities

In regions where tipping fees and liquid asphalt prices provide a less compelling, though still profitable, economic incentive for direct facility construction, Northstar plans to license its technology to recycling centres or waste collection facilities. Licensing agreements provide a highly profitable opportunity by generating revenue streams without the full responsibility for CAPEX and OPEX expenditures.

Before licensing its technology, Northstar plans to construct and operate at least five of its own facilities, making licensing likely to take place in 2028. This extension is to ensure that the technology is completely de-risked and its construction/operations can be consistently applied, allowing for predictable and reliable outputs.

While the company has not provided a great deal on the structure of potential licensing agreements, management has indicated that a facility processing 42,000 tonnes annually could generate approximately CAD 1 million in licensing fees (around 10% of gross revenue).

Facility Locations Based on Metropolitan Population Insights

Assuming Northstar can establish a 41,400 TPA facility in a metropolitan area with a population of around 1 million, and an 82,800 TPA facility in an area with approximately 2 million residents (as Northstar suggests, the Greater Toronto Area could support 3-4 facilities with a population of 6.7 million), The following model outlines potential regional locations for Northstar facilities and provides a breakdown of the number of facilities associated with each region.

As presented in the model, five metropolitan areas could support a 41,400 TPA facility, while 29 metropolitan areas have the capacity to host more than 67 Northstar facilities, each processing 82,800 TPA.

Click the following link below to access the data.

Facility Funding Strategies

Q3 2025 will be a crucial period for Northstar as potential funding partners evaluate the company's mid-November financial results, comparing Calgary's actual performance with the modelled projections. During this quarter, Northstar is expected to process 10,000 tonnes, with anticipated figures of approximately CAD 2.3 million in revenue, CAD 1.5 million in profit, and CAD 1.2 million in EBITDA. If the company achieves close to these figures, its economic model will be greatly derisked and with potentially significant funding opportunities unlocked.

Strategic Investments - TAMKO

In 2023, Northstar attracted a USD 10 million strategic investment from TAMKO, one of the leading asphalt shingle manufacturers in North America, whereby the company acquired a 19% stake in the company. The strategic investment was split into:

USD 6.4 million in preferred shares

USD 3.6 million in convertible debentures. The first USD 1.8 has yet to be converted and the remaining amount is pending upon further completion of certain milestones.

As part of the deal, TAMKO appointed Jeffrey Beyer, COO of TAMKO Building Products, to Northstar’s board. This is a significant move, as Beyer brings extensive expertise in the asphalt shingle market, offering valuable insights into operations and industry dynamics. His appointment strengthens the strategic alignment between the two companies, enhancing collaboration and potentially unlocking more business opportunities, including supply agreements and future acquisitions.

Northstar has an exclusivity agreement with TAMKO to develop four future US facilities, along with potential feedstock supplies and offtake agreements. Both companies are working closely to identify optimal site locations near existing TAMKO plants, ensuring that Northstar can maximise the economic potential of its facilities while strategically benefiting from proximity to TAMKO’s operations. Currently, TAMKO operates 8 facilities across the United States.

Grant Opportunities

Northstar’s future facilities may receive financial support from various local, regional, and national grants.

In 2021, Northstar partnered with Wellington Dupont Public Affairs to assist in engaging federal, provincial, and municipal stakeholders as part of its expansion plans across Canada and the United States. The collaboration also focused on evaluating potential non-dilutive funding strategies, including government grants, to help support the company's expansion efforts.

Northstar has already successfully secured CAD 7.3 million in government grants from Emissions Reduction Alberta and Alberta Innovates for their Calgary facility.

Corporate Debt - BDC

To fund its expansion, Northstar may issue corporate debt, such as bonds or loans, allowing it to raise capital without diluting equity. However, this is more likely to occur as the company strengthens its cash flows from operations.

Northstar has already secured a term sheet with the Business Development Bank of Canada (BDC) for a CAD 8.75 million secured loan to support its Calgary facility. The loan has a 15-year term and a fixed interest rate of 7.95%.

Facility Royalty Agreements - CVW CleanTech Investment

Facility royalty agreements offer an alternative funding approach, where investors provide capital in exchange for a share of the revenue generated by a specific facility.

Northstar has already secured a CAD 14 million investment by CVW CleanTech Investment via a five-year, 10% second-secured convertible debenture. This debenture will convert into a revenue royalty agreement for Northstar's next two facilities after Calgary, entitling CVW CleanTech to 12% of these facility revenues.

Self-funding from Free Cash Flow

As Northstar’s network of facilities expands, the accumulated free cash flow could enable partial self-funding for future plant constructions.

As illustrated in the Discounted Cash Flow model below, if Northstar's initial 4 facilities reach a processing capacity of 77,400 TPA, the accumulated free cash flow from full operations in 2026 would be sufficient to cover the CAPEX for 3 new facilities by 2027. However, since each facility will require time to scale up to the full capacity of 77,400 TPA, it is more likely that Northstar will be able to self-fund new facilities starting in 2028.

Equity Raises

Equity raises involve issuing shares to raise capital, allowing companies to secure funding without taking on debt. However, frequent equity raises can put pressure on the capital structure and affect overall shareholder value.

Discounted Cash Flow Model Forecasts

The following Discounted Cash Flow (DCF) model evaluates the projected cash flows, revenues, and expenditures for Northstar’s future facilities, presenting the company's Present Value up to 2030. The model also includes a detailed breakdown for each facility, factoring in current tipping fees and indexed asphalt prices.

Key Assumptions in the Discounted Cash Flow Model include:

Facility Capacity: First 15 facilities at 77,400 TPA each.

Tipping Fee Discount: 25% off the regional price.

Index Asphalt Discount: 20% lower than regional price.

Capital Expenditure per Facility: CAD 15 million.

PE Ratio: 10.

Discount Rate: 10%.

Click here to view detailed model assumptions and facility metrics.

The model is built from various data points provided by Northstar, key assumptions and real-world data. It aims to provide a representation of future performance, though the inherent uncertainties mean it may require adjustments.

As Northstar progresses with its operations and additional data is received, the model will be continually updated to reflect these developments.

Awarded Patents

United States

Northstar has been awarded two patents by the United States Patent & Trademark Office (USPTO), both valid until 2042. These patents were granted without additional engineering or legal challenges, underscoring the uniqueness of Northstar's technology globally.

Canada

Northstar also has a patent for its asphalt shingle reprocessing technology in Canada, which is valid until 2042.

Global

Northstar Clean Technologies has begun the process of securing international patent protection through a Patent Cooperation Treaty (PCT) application, covering potentially 157 contracting states worldwide.

Competing Technologies

RAS (Recycled Asphalt Shingles)

Recycled Asphalt Shingles (RAS) are materials that come from deconstructed old asphalt shingles. These shingles are processed and repurposed for use in hot mix asphalt (HMA) for road construction.

The RAS process involves grinding discarded shingles into smaller pieces and separating their components. The asphalt binder, which hardens over time, is treated to restore its original viscous consistency, enabling it to blend effectively with HMA ingredients.

While RAS typically constitutes 5-10% of the HMA mix, its use faces challenges due to quality variability, issues caused by binder oxidation and limitations on its use in various jurisdictions.

GAF

In 2021, GAF developed three patented processes to recycle shingle waste, which achieves a 90% material recovery rate. This process produces recycled briquettes that currently represent 7% of recycled content in GAF’s Timberline HDZ® RoofCycle™ series.

In June 2022, GAF announced plans for a commercial asphalt shingle recycling facility in Corsicana, Texas, scheduled for completion by the end of 2023. However, as of December 2024, satellite imagery shows no progress. The Texas Department of Licensing and Regulation now lists the project's completion as May 2025. Given the lack of updates and no visible progress since 2022, it appears the project has been delayed or put on hold.

Owens Corning

Owens Corning is advancing two methods for shingle recycling:

Shingle Waste to New Shingles: Breaking shingles into their three components

Shingle Waste to Asphalt Paving: Repurposing waste for paving applications.

In late 2022, the company announced plans for a pilot facility in Indianapolis in partnership with ASR Systems, CRS Reprocessing Services, and Indiana Shingle Recycling. However, as of now:

Indiana Shingle Recycling is listed as "temporarily closed" on Google.

Emails to the Indiana Shingle Recycling bounce back.

Satellite imagery shows no new facilities at the proposed site since 2022.

Without further updates, it can be assumed that the pilot project is not proceeding. However, Owens Corning's technology has still proven successful in laboratory conditions; therefore, the technology is still validated.

CertainTeed

In 2023, CertainTeed, a subsidiary of Saint-Gobain, acquired the RenuCore™ technology from Asphaltica. This process recycles asphalt shingles into pellets for use in hot-mix asphalt paving. Key advantages of this technology include improved resistance to rutting, shoving, and cracking and enhanced durability and longevity for paved roads.

The technology debuted at the Shingle Recycling Forum in October 2024, with CertainTeed planning to license it to recycling facilities and paving companies. However, its application is limited to paving, and several states restrict or ban the use of recycled shingles in HMA.

SkyQuarry

SkyQuarry has developed a patented process called ECOSolv, which, like Northstar, separates shingles into their components with a 95% yield rate. However, their business model and execution raise concerns.

SkyQuarry plans to establish collection centres across the U.S. to partially process asphalt shingles before transporting them to their Utah facility for final extraction. The refined bitumen is then shipped to their Nevada facility again for further processing.

Concerns about SkyQuarry include:

Excessive Transport Requirements: The decentralised model significantly increases logistics costs and leads to major feedstock supply issues.

Credibility Issues: The company raised funds via crowdfunding in 2022 and listed on NASDAQ in October 2024, where its stock has since dropped 70%.

Lack of Professionalism: Their website lacks detailed growth plans and falls short of professional standards, appearing outdated and underdeveloped.

Financial Instability: The company has CAD 17.7M in liabilities against a CAD 21M market cap.

Competitive Landscape

Given the vast scale of the shingle waste problem, there are likely to be multiple players in the recycling market. Northstar's success does not rely on building 200+ facilities. As previously highlighted in the DCF model, constructing and operating just 15 strategically located facilities can deliver substantial returns for investors.

Competition for key market locations emphasises the need for Northstar to swiftly expand to secure strategic locations with the best economic conditions.

Northstar's Leadership Team

Northstar’s management team brings extensive experience across a range of industries, including energy, finance, mining, construction, and corporate governance, providing the company with the expertise to navigate complex challenges and drive future growth.

Despite facing initial hurdles, Northstar’s management team has navigated the financial and operational complexities with impressive skill. They have worked diligently to establish a solid platform foundation, positioning the company for accelerated growth once the Calgary facility demonstrates its viability.

However, to instil greater confidence in the market, management must provide a clearer roadmap for future facilities. Instead of relying on broad statements, a detailed, step-by-step approach outlining specific milestones and actions is needed. This will offer transparency and a clearer understanding of the company’s strategic direction, particularly for 2027 and beyond.

Capital Structure

Northstar currently has 158.8 million shares outstanding, with a fully diluted count of 287 million shares. This dilution represents a substantial increase in the share count and is a factor for investors to carefully consider.

The ownership structure consists of management holding 13%, TAMKO 19%, institutional investors 3%, and retail investors holding the remaining 65%.

Outstanding Options & Warrants

As of September 2024, Northstar has the following share structure

Strategic Funding Since the IPO

Since July 2021, Northstar has raised a total of CAD 67 million, including CAD 30 million from non-dilutive sources and CAD 37 from equity sources. While equity raises remain a possibility for future facilities, the company is progressively positioned to secure non-dilutive funding, as its operations advance and its technology continues to de-risk.

The CAD 37 million in equity funding to date has been raised through:

2021: CAD 12.2 million in initial public offering (IPO).

2022: CAD 500,000 strategic investment from Renewable U Energy.

2023: CAD 10 million strategic investment from TAMKO.

CAD 14.3 million from convertible notes, options, or warrants.

Importantly, Northstar has secured the majority of its funding from strategic partners, without the continual need of going to retail investors, reflecting strong alignment with key stakeholders and industry leaders.

Key Risks and Considerations

Disclosure: All investments carry inherent risks, and past performance or projections do not guarantee future results.

Technology Risk: While Northstar's technology platform has been successfully demonstrated at pilot scale, ramping up to full commercial operation will always carry inherent risks. Unexpected technical hurdles at the Calgary facility could lead to lower-than-expected production volumes, inconsistent product quality, or increased operating costs.

Unsustainable Economics: The economic viability of each Northstar facility relies on a delicate balance of numerous factors. Fluctuations in tipping fees and liquid asphalt prices could impact revenues. Securing a consistent supply of asphalt shingles is also crucial to operations. Additionally, operational costs, including labour, utilities, and maintenance, need to be carefully managed whereby unexpected variations could negatively affect profitability.

Permitting Uncertainties: Northstar's expansion plans rely on successfully obtaining permits for each new facility. Delays in the permitting process due to complex regulations, local opposition, or government hurdles could stall construction, increase costs, and ultimately hinder the company's growth trajectory.

Competitor Threats: As the asphalt shingle recycling market is still emerging, new competitors with more efficient or cost-effective platforms could emerge, potentially challenging Northstar's current first-mover advantage. Additionally, securing long-term, exclusive agreements with feedstock suppliers in strategic locations is crucial, and competitors could limit Northstar's access to raw materials and hinder its expansion plans.

Shareholder Dilution: Northstar's ambitious expansion plans require significant capital investment and if the company is required to issue new shares to fund this growth, then existing shareholder ownership will be reduced. This is particularly a concern in the early stages of their commercialisation plans when the company’s profitability may not yet be sufficient enough to fund its fund growth.

Resources & Links

Disclaimer: I currently am a shareholder of Northstar and therefore have a vested interest in its success. I was not compensated in any form by the company to create this post.

My opinions are not investment recommendations and should not be relied upon for decisions. Information may be incomplete or subject to change. Investors should conduct their research and consult a qualified adviser.

Investments carry risks, and past performance does not guarantee future results. I am not liable for financial losses based on this material. This content is not an offer or solicitation to buy or sell securities. Readers should verify information independently before acting.

Hi, James--really appreciate the work you've put into pulling together this story and model.

I've been combing through your DCF and hit what I think are a couple of minor typos, one methodological error (I think) and curious about what I see as a gaping hole!

typos - in the years when you're adding individual plant revenues and multiplying by 6 month construction and 6 month ramp up (effectively, recognizing a quarter of revenue in first year), the parentheses should be around the sum of the facilities, e.g, (a + b + c) * (0.25). In two years, '26 & '28 I believe, you have (a + b + c * (0.25)). It takes 2026 revenue from $43M to $27.3M.

net present value - I believe NPV should be sum of two PVs: discounted cashflows and discounted terminal value. Your 'Terminal Value' is NPV of final P/E multiple as a final period cashflow (which should work), but then you calc a second PV on that already discounted amount. PV(term) should be about 2x higher. Then I think NPV should be sum of both--jacks up share PV quite a bit.

gaping hole(?) - I'm far less sure about this, but I don't understand how you've covered facility construction capex. You seem to be allocating a certain amount of cash from ops to next year's cap ex, but I don't see where the rest comes from. For example, by YE 2027, 6 facilities have been built at a cost of $90M, but I can't see where those funds come from. You pay off the $8.8M loan over Y1 and Y2, but need to raise $90M over the same period.

Putting all of this together, ROOF accumulates $100M LT debt that puts an $10M interest payment drag on profitability, dropping PV(cash) to $126 from $163. But including a 2x PV(term), even arbitrarily dropping the P/E multiple to 8x for the debt, boosts the NPV to $638M, or $2.22 per diluted share.

Let me know if you'd be interested in looking at a copy of my edited version.

Very extensive write up and deep dive. But the bigger issue is that the stock is illiquid. less than 300k shares traded per day. I will subscribe to check out your other content.