Aduro Clean Technologies: Revolutionary Plastic Recycling Technology

Aduro Clean Technologies is revolutionising chemical recycling with its patented Hydrochemolytic platform, converting low-value waste plastics, heavy crude and renewable oils into high-purity fuels.

Please review Slack Capital’s Investment Disclaimer prior to reading this report.

Company Overview

Aduro Clean Technologies is an early-stage technology development company advancing a next-generation, patented chemical recycling platform that can transform waste plastics into higher-value chemicals and fuels, heavy crude oil and bitumen into lighter oils and renewable oils into green fuels and chemicals

Headquartered in a new state-of-the-art laboratory and office facility in Ontario, Canada and with operations across the globe, Aduro’s operations centre on its patented Hydrochemolytic Technology (HCT). The following research report provides an overview of the technology and the compelling opportunities it presents for both the company and its shareholders.

Unless otherwise stated, the majority of this report will focus on Aduro’s plastic upcycling vertical. This is due to most of the public information released by Aduro relates to this area however, this focus does not diminish the significant opportunities presented by the company’s additional verticals.

Hydrochemolytic Technology

Aduro’s Hydrochemolytic technology uses water (Hydro) and the chemical deconstruction of molecules (Chemolysis) to enable a more precise breakdown of feedstock materials, resulting in higher-quality yields at low CAPEX and OPEX. The company’s unique process transforms large, stubborn, low-value molecules into smaller, lighter and higher-value compounds.

Aduro compares their process to existing legacy technologies as using ‘scissors’ versus a ‘sledgehammer’. While both methods separate hydrocarbon molecules, they do so in very different ways, leading to distinctly different outcomes.

In this analogy, the ‘sledgehammer’ approach requires significantly more operational intensity and often results in a lower-quality end product. In contrast, Aduro’s ‘scissor’ approach requires far less effort and produces a more tunable, precise and higher-quality result.

Applying Aduro’s technology to the real world, in the case of Hydrochemolytic Plastics Upcycling, their reactor platform can convert post-consumer waste plastic, including contaminated materials and chemically deconstruct it into higher-value products such as diesel fuel for cars.

The core of Aduro’s technology lies in its chemical reaction process, which takes place within the company’s reactor platform:

The chemical conversion begins with the introduction of either post-consumer plastics or heavy bitumen into a series of reactors, each operating at different severity levels depending on the complexity of the feedstock.

Water serves as the medium for the chemical reaction. It also plays a role in transferring heat, transporting co-agents and maintaining the suspension of liquid intermediates and co-agents/catalysts within the reactor.

Low-cost, bio-based sources such as biomass are used to generate hydrogen equivalents, which improve product quality. Importantly, HCT does not use molecular hydrogen instead, it relies on hydrogen-rich compounds like glycerol, cellulose, ethanol and methanol.

Low-value catalysts are also introduced into the reactor to achieve the necessary concentration levels.

Water containing both the hydrogen equivalent and catalyst enters the reactor and is mixed with the liquid intermediates.

The upgrading chemistry involves simultaneous molecular deconstruction and saturation of the broken chains, significantly simplifying the process and reducing the need for downstream post-processing.

The resulting liquid product is directed to a separator, where water and gas are removed from the final output.

Thanks to the low-severity conditions, including temperatures below cracking thresholds, the amount of gas produced in the reactor is relatively low, which is key to achieving a higher liquid yield.

The final liquid hydrocarbon output is nearly fully saturated (approx. 97%) and does not require additional hydrogenation. It can be used or sold directly to end customers without further post-processing.

While I like to break down and simplify information for my readers, I don’t have a technical background and it did take me some time to fully understand the process Aduro has developed. To support readers with their own comprehension, I’ve included several helpful resources at the end of this article.

The most informative resource on Aduro’s Hydrochemolytic technology is a YouTube interview with their Chief Scientist, Anil Jhawar, who provides an excellent overview. I highly recommend watching it.

Currently, Aduro is focused on three distinct market verticals though additional applications are currently being explored by the company’s R&D team.

Hydrochemolytic Plastics Upcycling (HPU)

Stage - Pilot Program

Aduro’s Hydrochemolytic technology enables the transformation of contaminated waste plastics into higher-value resources for the circular economy by recovering, regenerating and reusing materials rather than discarding them.

When applied to contaminated waste polyethylene (plastic bags) and polypropylene (bottle caps), Aduro’s technology can chemically convert these materials into high-quality outputs suitable for use in naphtha cracker facilities that produce olefins and aromatics. Polystyrene (styrofoam cups) which poses significant challenges for most conventional recycling methods, can also be reverted to its original monomer and reused to manufacture new polystyrene.

To date, results have shown that when polyethylene is processed through Aduro’s HPU platform, the liquid yield reaches 90%, the gaseous yield is 6% and solids/ash content is 4%. In comparison, while Pyrolysis recycling achieves an average efficiency of ~78%, Aduro’s HPU technology delivers an efficiency exceeding 85%, with an output purity of approximately 97%.

Aduro’s Hydrochemolytic Plastics Upcycling process is also highly tunable. By adjusting key parameters such as temperature, pressure, space-time and the water-to-polyethylene ratio, the platform can target specific output profiles. As illustrated below, Aduro can tailor its chemical processing to reach a carbon range of C14–C24, which aligns with diesel-grade oil used in cars.

Translating this into real-world economics, Aduro’s CEO Ofer Vicus, has previously stated that their platform can convert plastic valued at approximately $200 per tonne into output worth between $800 and $1,300 per tonne.

Hydrochemolytic benefits over current technology

A note at the end of this report, I provide further information on the existing legacy technologies within the plastic recycling industry.

As we all know, the global plastic waste crisis is extensive and expected to worsen alongside continued population growth. Looking ahead, it is unlikely that a one-size-fits-all solution will emerge. Instead, the future will likely see a range of specialised chemical processing platforms, each serving distinct niches within the recycling ecosystem.

Hydrochemolytic Bitumen Upgrading (HBU)

Stage - Pilot Program

Aduro’s Hydrochemolytic processing platform can significantly enhance the physical and chemical properties of low-value bitumen and heavy crude by chemically deconstructing them into lighter, higher-value molecules.

The platform precisely targets asphaltenes and other ‘heavy’ compounds commonly found in bitumen and heavy crude oils, comprising up to 25% of Alberta bitumen. These problematic compounds make the resource extremely dense and viscous, preventing it from meeting pipeline transport requirements and leaving bitumen producers with only two options.

Transform the bitumen into a lighter “synthetic crude” through complex operations that are both capital- and energy-intensive.

Reduce the thickness of the bitumen by diluting it with costly light hydrocarbons (such as light oil).

Further information on these two conventional processes is provided at the end of the report.

Aduro’s HBU platform can chemically deconstruct heavy components by using water to selectively ‘cut’ the asphaltenes into smaller fragments, which are then stabilised. The technology also reduces levels of sulphur, metals and acid number in the feedstock.

Performance to date has shown that Albertan bitumen with an API gravity of 11° can be upgraded to an API of 20°.

Aduro’s reactor units can deliver a 30% uplift in the economic value of bitumen relative to benchmark prices, while also reducing diluent use by up to 90% compared to conventional technologies. According to the company, their platform can conservatively add between $7 and $15 per barrel, depending on the initial crude quality.

Hydrochemolytic Renewables Upgrading (HRU)

Stage - Advanced Research

Aduro’s chemical conversion process can also transform renewable oils (lipid feedstocks) into renewable chemicals, bio-jet fuel and drop-in diesel.

These renewable oils include inedible corn oil by-products from ethanol production, oils from non-food seed crops, off-spec canola and soybean oils and yellow or brown grease from restaurants, waste streams that often end up in wastewater treatment plants.

This vertical remains under active research by Aduro’s team.

Additional Market Verticals

While the company is currently focused on plastics upcycling, bitumen upgrading and renewable oil upgrading, there are other potential applications for the technology including car tyres, foam mattresses and used lubricant engine oils.

Current Stage of Development - Reactor Units

R1 Unit

Aduro began developing its patented technology platform in 2011, initially focusing on the upgrading of heavy bitumen. Since then, the company has achieved several key milestones in advancing its R1/Laboratory Bench Scale Units, which currently produce outputs measured in millilitres per hour.

R2 ‘Continuous Flow’ Units - Current Stage of Development

R2 Plastic Reactor Unit

In April 2023, Aduro commissioned its continuous-flow Plastic Reactor, designed to chemically convert waste polymers into higher-value liquid hydrocarbons. This upscaling reactor achieves outputs in the range of litres per hour.

Following this commissioning, Aduro is now focused on conducting targeted experiments to generate the critical data needed to inform the design of its upcoming R3 reactor. This data will also support applications for funding grants that could accelerate the development of the company’s operations.

The R2 plastic reactor design exceeded the baseline requirements for chemical conversion, incorporating a number of additional mechanisms. This has enabled Aduro’s team to expand the range of parameters tested. In contrast, the future R3 reactor will adopt a more streamlined design, focused solely on the most efficient and commercially viable performance ranges identified through R2 testing.

R2 Bitumen Reactor Unit

In October 2022, Aduro commissioned its Bitumen Reactor, enabling the company to begin customer engagements and testing of various material inputs.

Both R2 reactor units support Aduro in achieving the following:

Conducting internal parameter testing, experimentation and research to further deepen their understanding of the Hydrochemolytic technology.

Refining the engineering design for the upcoming R3 reactor.

Initiating their customer engagement program, which generates revenue while also contributing valuable data. By engaging customers early, Aduro aims to build strong industry relationships and ensure that once the technology is fully commercialised there will be customers ready to adopt it.

To date, Aduro has not failed a single evaluation metric in either of its R2 programs. In fact, one existing customer recently expanded the scope of their testing program, increasing their funding commitment by 450%.

R3 Pilot Plant Unit - Future

Given that Aduro has demonstrated its chemical processing technology can meet key performance metrics, the remaining question is whether it can scale commercially, maintaining high-quality material yields while keeping CAPEX and OPEX low.

The development and commissioning of the R3 units will represent a major de-risking milestone for the company, as they will demonstrate the technology’s ability to perform at a commercial scale.

R3 Plastic Reactor Unit

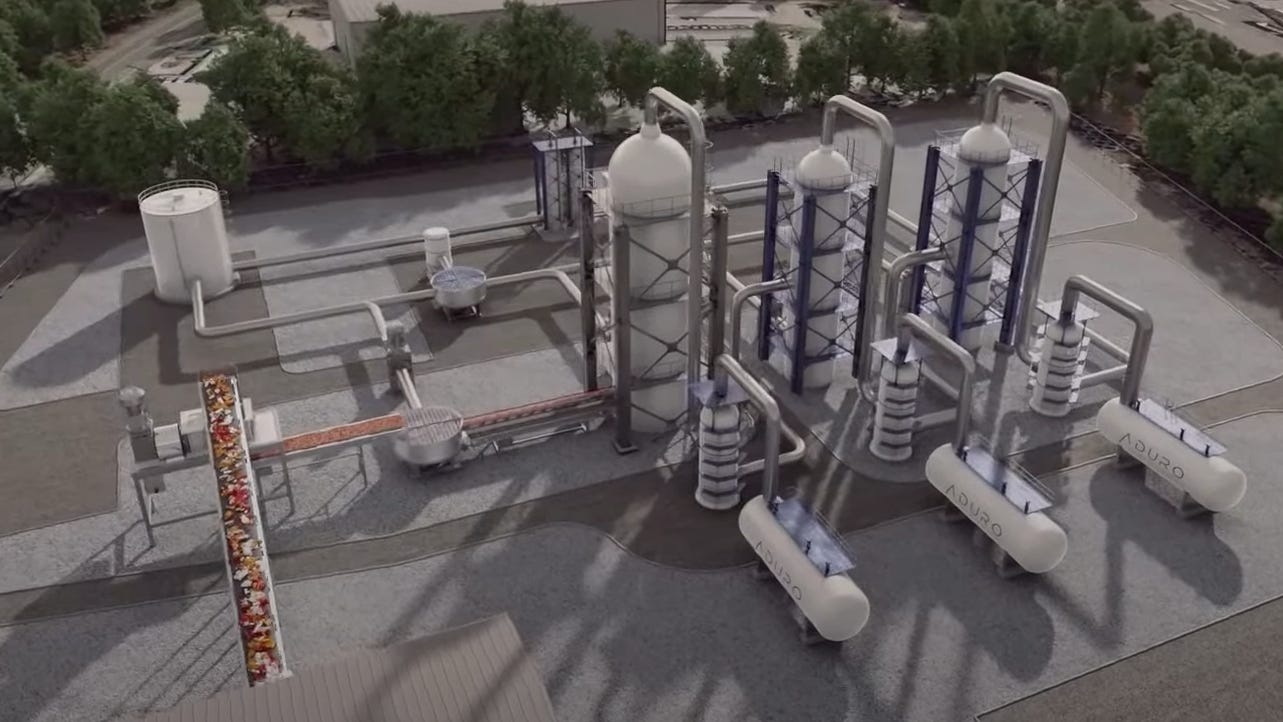

Aduro recently announced that it expects to commission the R3 plastic reactor unit in early 2025. This larger-scale system will mark a significant step forward, with the capability to process tonnes of feedstock materials per day.

The R3 HPU unit will be 20 times the scale of the current R2 plastic reactor and will be constructed at the Brightlands Chemelot Campus in the Netherlands. It is expected to process up to 10 tonnes of plastic per day.

R3 Bitumen Reactor Unit

No formal guidance has been provided on the expected commissioning date for the R3 HBU reactor unit. However, current expectations suggest the unit will be capable of processing 5 to 10 barrels per day.

Commercial Unit - Future

Plastic Reactor Unit

Aduro initially plans for its commercial HPU platform to chemically process 25 tonnes of waste plastic per day, with the flexibility to scale up processing capacity over time.

The estimated cost of each commercial reactor unit is $22.5 million.

Customer Engagement Program

Aduro currently has five active customers participating in its R2 program across both the HPU and HBU platforms. Among them, one is a petrochemical company, three are plastic producers and one is a plastic converter. Notably, four of these five customers are multi-billion-dollar companies.

In a public statement, Prospera Energy’s CEO inadvertently revealed that one of the multi-billion-dollar oil companies involved in Aduro’s R2 HBU program is ConocoPhillips (market cap: $138B). However, due to signed NDAs Aduro is unable to officially confirm the customer’s identity.

Beyond its active engagements, Aduro holds over 20 dossiers from interested parties across all major continents. As the company progresses through its 2024 work program, it anticipates that several of these prospects will convert into paid participants in the Customer Engagement Program. Additionally, Aduro has noted that additional companies are monitoring from the sidelines, waiting for the technology to reach full commercial scale before initiating engagement.

Aduro’s Customer Engagement Program runs for 3 to 6 months, depending on the scope of the customer’s trial requirements. Each engagement generates revenue between $125,000 and $300,000, based on the complexity and scale of the program.

Key Industry Partnerships

Shell

In November 2022, Aduro Clean Technologies was selected to join Shell’s prestigious GameChanger program, an accelerator initiative designed to support the development of innovative net-zero solutions through strategic partnerships.

The program is known for its highly selective entry process, given the substantial benefits it offers. These include non-dilutive funding, access to technical expertise and support in shaping commercialisation strategies.

Aduro’s participation in the program is ongoing, with updates on its performance expected to be released in Q1 2024.

Shell is currently ranked as the 51st largest plastic waste producer globally, generating approximately 1 million tonnes of plastic annually. The company has set a goal to recycle an equivalent volume, 1 million tonnes, by 2025.

Chemelot Innovation and Learning Labs (CHILL)

In March 2023, Aduro partnered with CHILL to launch an experimentation program at the Brightlands Chemelot Campus.

The campus is Europe’s largest innovation and incubator hub, home to over 3,000 professionals across more than 120 companies, all dedicated to solving global challenges and advancing sustainability in the chemical industry.

This partnership grants Aduro access to a broad network of support across Europe, including industry leaders, engineering firms, strategic investors and funding bodies. It also enhances Aduro’s visibility and credibility in the region while promoting business development and deepening industry engagement.

Gaining entry to the Brightlands campus is highly competitive. Companies must pass a rigorous vetting process and most applicants are ultimately rejected. Over several months of evaluation, CHILL was thoroughly impressed with Aduro’s novel Hydrochemolytic technology and accepted the company into its program.

Notably, Eric Appelman, who previously served as Brightlands’ Executive Vice President of Business Development and Chief Technology Officer, was so impressed by Aduro’s platform that he left his role at CHILL to join Aduro. He now serves as the company’s Chief Revenue Officer and European lead.

During his time at Brightlands, Eric had worked with more than 70 companies, many of which used conventional legacy technologies with minor variations. When Aduro first joined the campus, he was intrigued but skeptical of the company’s claims. However, after observing the Hydrochemolytic process in action over several months, his reservations turned to conviction and he became one of Aduro’s strongest advocates.

Prospera Energy

Prospera Energy, a Canadian heavy oil operator, partnered with Aduro in late 2022 to execute a three-phase development program.

Phase 1, currently underway, involves testing bitumen feedstocks and evaluating the project economics.

Phase 2 will cover preliminary engineering, site selection for the pilot plant, licensing and permit reviews, detailed budgeting and a formal agreement to proceed with construction.

Phase 3 includes the procurement, fabrication, construction, commissioning and operation of a 50 bbl/day pilot plant, with the potential to scale up gradually to a 3,000 bbl/day commercial facility.

Results from Phase 1 are expected in Q1 2024.

Exergy Solutions & Rally Engineering

Although Aduro maintains an internal engineering team, it is also supported by high-calibre external consultants, along with technical and strategic guidance provided through Shell’s GameChanger program.

Business Model Execution

Although Aduro’s Hydrochemolytic technology platform is highly promising, the company remains early in its technology life cycle. Several key milestones must still be achieved before reaching full commercialisation and large-scale operational success.

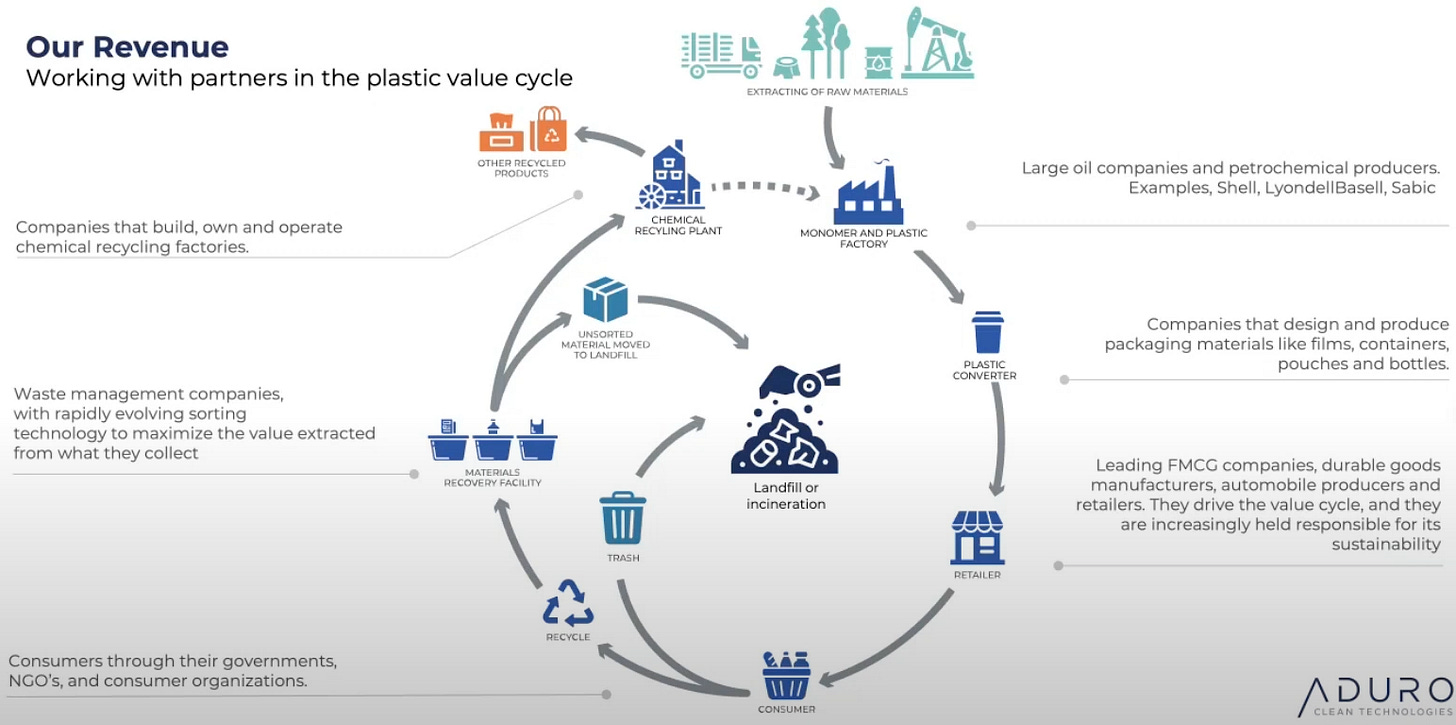

As the technology scales, so too will the execution of management’s broader corporate development plan. In addition to customer partnerships, project execution and continued R&D, Aduro will begin to implement its commercial business model.

Given the wide-ranging advantages of the Hydrochemolytic platform, Aduro is well-positioned to serve a broad spectrum of end customers.

Regulated vs unregulated environments

Government vs. private organisations

Large vs. small scale operations

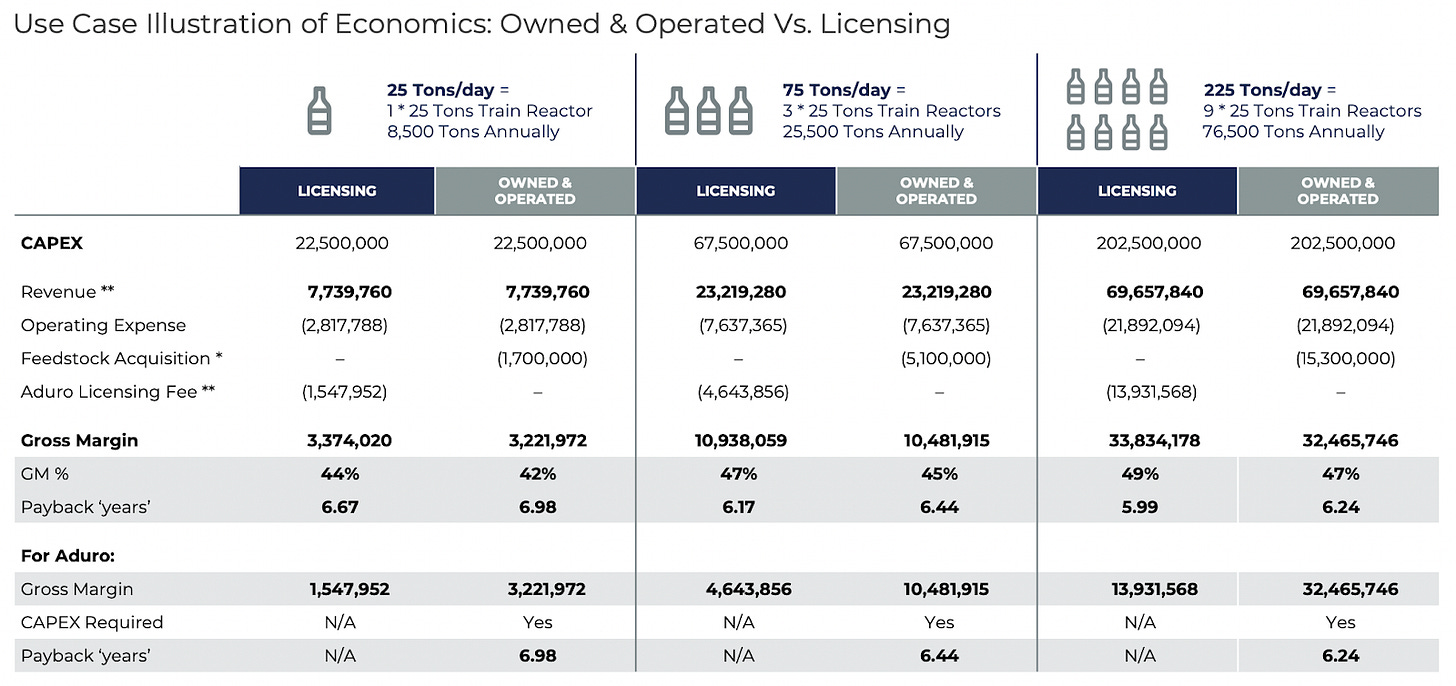

Licensing Model

Currently, the leading and most economically attractive business model for Aduro is a licensing agreement model. Under this structure, Aduro keeps ownership of its patented Hydrochemolytic technology and grants other companies the rights to use the platform. In return, licensees pay a licensing and royalty fee based on the gross margin generated from the material outputs.

This model enables Aduro to monetise its technology without the need to construct or operate the processing units directly, significantly reducing capital expenditure and operational costs. Aduro expects to receive a 20-30% royalty on the gross margin of the outputs produced by licensees.

Additional advantages of this model include reduced execution risk, easier market entry into new regions, greater focus on R&D and the preservation of intellectual property.

Moreover, if a licensee chooses to expand their chemical recycling operations, additional units can be deployed, resulting in increased revenue for Aduro without incurring further capital costs.

Owned & Operated

In addition to the licensing model, Aduro may also pursue an owner and operator model, where the company retains full ownership of its technology platform, funds the construction of facilities and directly manages all operational aspects.

Under this model, Aduro would be responsible for securing government permits, sourcing and storing feedstock, operating the facilities with its own personnel and marketing and selling the recycled outputs. While this approach offers higher profit margins, it introduces significant operational complexity, areas that currently fall outside Aduro’s core competencies. This model is not favoured at the company’s current stage of development.

However, Aduro has indicated that if it were to adopt this model, it would likely seek partnerships with funding bodies, such as government agencies, to help subsidise recycling operations.

That said, Aduro does plan to construct operational hubs in key global markets to showcase its technology and build industry awareness, similar to its current presence at the Brightlands Chemelot Campus.

Take Over

Given the disruptive nature of Aduro’s technology, it’s likely that other companies are closely monitoring the company’s progress. In the future, once Aduro achieves commercial success, it could become a potential target for a takeover offer.

Revenue Forecast

While the R2 units are currently generating revenue through Aduro’s customer engagement programs, this income remains modest compared to the company’s long-term projections.

Based on conservative estimates, Aduro forecasts that upon reaching commercial scale in 2025, it will generate approximately $14 million in recurring revenue. By 2027, this figure is expected to rise to $95 million as more reactor platforms become operational with partnered customers. The projected EBITDA for 2027 is $78.6 million, reflecting a margin of over 80%.

Importantly, these forecasts are based on just 12 small-scale processing units and do not account for the potential impact of a single large partnership, which alone could meet or exceed the $95 million revenue target. It’s worth noting that Aduro is currently engaged with over four multi-billion-dollar companies and has interest from more than 20 others globally.

With minimal capital outlay and low OPEX under the licensing model, Aduro’s forecasted 80% EBITDA margin in 2027 suggests two key outcomes:

Continued investment in R&D to advance the Hydrochemolytic platform, opening up additional market verticals.

The potential for significant dividend distributions to shareholders, supported by strong recurring cash flows.

Why I Invested in Aduro:

Opportune Markets & Timing

Aduro’s platform technology is applicable across multiple market verticals, each representing a significant blue-sky opportunity given the scale of their addressable markets.

Total Addressable Markets

Plastics upcycling: $120 billion by 2030

Bitumen upgrading: $50 billion

Renewable oil upgrading: $121 billion

Significant Technological Advantages

As illustrated in the HPU section table, Aduro’s technology offers several key advantages over existing legacy systems. To highlight again:

Low CAPEX and OPEX requirements

High yields of over 80% and operating margins approaching 50% for customers

Lower operating temperatures, reducing chemical complexity

Ability to process various plastic types without costly pre-treatment

Utilises simple, inexpensive and widely available catalysts, along with water

Scalable reactor units suitable for both regulated and unregulated environments

Customers Engagement

Aduro currently has five multi-billion-dollar companies participating in its customer engagement programs, with over 20 additional companies in active discussions. By establishing these partnerships early, Aduro aims to ensure that once its technology reaches commercial scale, previously engaged prospects can be rapidly converted into revenue-generating clients.

Key partnerships

Aduro has partnered with influential players across its targeted market verticals. Inclusion in both the Shell GameChanger and CHILL programs, each known for their highly selective entry criteria, offers strong validation of Aduro’s technology and reinforces its position within the chemical recycling industry.

Low SOI & Loyal Shareholders

Aduro currently has 64,988,838 shares on issue, along with 31,859,256 warrants (including stock warrants and employee stock options), bringing the total fully diluted share count to 96,848,094.

Management holds approximately 43% of the 65 million outstanding shares, demonstrating strong alignment with shareholder interests. This leaves just 37.7 million shares available for public trading. Notably, CEO Ofer Vicus alone holds over 20.7 million shares. As a result, the stock has an extremely limited free float, making it difficult for investors to accumulate sizable positions.

High-Profit Margins & Revenue Pathways

By adopting a licensing model, Aduro is forecasting EBITDA margins of over 80%. This high-margin structure will allow the company to reinvest heavily into R&D, unlocking new market verticals and additional revenue streams. For shareholders, this presents a compelling opportunity to participate in what could become a future cash-generating business capable of delivering substantial dividends.

Fantastic Management Team

The management team at Aduro Clean Technologies is highly impressive and has, to date, executed business development and operations with diligently. The company has successfully attracted influential industry leaders and is building a world-class team to drive the business forward.

Exchange Uplisting

Aduro Clean Technologies is currently listed on smaller exchange markets. In their December 2023 webinar, the company indicated plans to uplist to a major exchange, either the TSX or Nasdaq, as the business matures. However, no specific timeline has been provided for this potential move.

Investor Awareness

Aduro currently remains under the radar of most investors and hedge funds. However, this presents a meaningful opportunity for early investors to accumulate shares at what may be a relative discount. With an extremely limited public float, any future surge in buying pressure could result in significant share price movement.

The company has also been actively participating in global conferences targeting both investors and industry stakeholders. According to management, Aduro has been exceptionally well received at these events.

Unique patented technology

Aduro currently holds seven patents related to the chemical processing aspect of its technology, with an additional two to four patents expected to be filed in 2024. It’s important to note that these patents specifically cover the chemical processes themselves, not the physical facilities in which the reactions occur. The unit infrastructure is composed of standard, off-the-shelf components already in use across various industrial sectors.

In addition, Aduro’s dedicated research and development team continues to explore new market verticals where the Hydrochemolytic platform can be applied.

Risks

Commercial success of the R3 reactors

One of the key risks facing Aduro is the successful commissioning and operation of its R3 plastic reactor unit. Achieving strong performance at this stage will bring the company significantly closer to full-scale commercial operations.

However, if the R3 unit initially fall short of its performance targets, it should not be viewed as a failure of the underlying technology. Given that the R1 and R2 units have already met their respective benchmarks, any shortfall at the R3 level would likely require adjustments to the reactor’s design or chemical processing parameters, rather than indicating a fundamental flaw.

Aduro has publicly stated that they do not view scaling as a major risk, largely due to the low-severity operational environment in which their technology operates.

Capital Requirements

As of 31 August 2023, Aduro reported a cash balance of $2.96 million.

With the upcoming expansion of operations and the associated construction costs of the R3 reactor unit, a capital raise may be required in the coming year. However, the company has outstanding warrants due in April 2024, which could provide a meaningful cash buffer. This is in addition to revenue generated from its R2 customer engagement program.

Aduro may also secure non-dilutive funding through government grants, which the company has successfully obtained on multiple occasions in the past.

Business Execution

There is a risk that Aduro’s management may fail to effectively execute its corporate development plan, potentially resulting in reduced market capture and lost revenue opportunities. However, given the strength of the current leadership team and their proven track record to date, IMO this risk as relatively low.

Competition Risk

As with most technologies, there is always the risk that a more efficient solution could emerge. Across Aduro’s three target verticals, hundreds of companies are competing. That said, industry feedback and Aduro’s inclusion in both the Shell GameChanger and CHILL programs offer strong validation. If the technology proves commercially scalable, it is well positioned to secure a meaningful foothold across all three sectors.

Resource List

Arrowhead Equity Research Report - Estimated fair value bracket of CAD $3.80 - $5.30

Aduro Video Series - MUST WATCH COMPANY INTERVIEWS

Independent Investor Aduro Playlist Videos

Investor Community Forums

Report Notes

Plastic Recycling Competing Technologies

Plastic waste is a significant global issue and requires a calculated approach to curb the problem. The following information relates to existing legacy technologies that are competing for market capture against Aduro Clean Technologies Hydrochemolytic Process

Solvation (Mechanical)

Solvation plastic recycling, otherwise known as mechanical recycling, is a process in which waste or scrap plastic is sorted, cleaned and then mechanically shredded into small pieces. The resulting plastic "flakes" are then melted down and moulded into new products.

Mechanical plastic recycling has some limitations, including:

Limited types of plastic: Mechanical recycling is typically only effective for certain types of plastic, such as polyethylene terephthalate (PET) and high-density polyethylene (HDPE). Other types of plastic, such as polyvinyl chloride (PVC) or polystyrene (PS), may be more difficult to grind or meltdown and they may produce harmful byproducts when they are processed.

Contamination: Plastic waste that is mechanically recycled must be thoroughly cleaned and sorted before it can be processed. If the plastic is contaminated with other materials, such as paper, metal, or food waste, it may be difficult or impossible to recycle.

Quality degradation: The mechanical recycling process can result in a loss of quality in the recycled plastic, as the plastic may become degraded or contaminated during the grinding and melting process. This can make it less useful for certain applications and may decrease its market value.

Energy and resource intensive: Mechanical recycling requires a significant amount of energy and resources, as it involves grinding and melting plastic waste. This can make it less environmentally friendly than other recycling methods, such as chemical recycling or biological degradation.

Limited end products: Mechanical recycling is typically only suitable for producing lower-quality products, such as plastic lumber or containers for non-food items. It is not typically used to produce high-quality products, such as food packaging or medical devices, which require purer and more consistent plastic.

Gasification

Gasification plastic recycling is a process in which waste or scrap plastic is converted into a synthetic gas through a high-temperature, oxygen-deprived environment. The syngas can then be used as a fuel or chemical feedstock, or it can be converted into other products, such as chemicals, fuels, or electricity.

Gasification plastic recycling has some limitations, including:

It requires specialized equipment. Gasification plastic recycling requires high-temperature reactors, gasifier and other specialized equipment in order to convert the plastic into syngas. This can make it expensive and complex to set up and operate a gasification plastic recycling facility.

Emissions: Gasification plants can produce a variety of emissions, including carbon dioxide, sulphur dioxide and nitrogen oxides, which can have negative impacts on air quality. These emissions may need to be controlled or captured to minimize their environmental impacts.

It is not suitable for all types of plastic. Some types of plastic, such as PVC and PET, cannot be gasified because they are difficult to break down into their constituent molecules.

It is not always cost-effective. Gasification plastic recycling can be expensive, especially if the plastic being recycled is contaminated or mixed with other materials. This can make it difficult for recyclers to recover the costs of the recycling process, which can make it less attractive as an option.

Thermolysis (Pyrolysis)

Thermolysis plastic recycling is a process in which waste or scrap plastic is heated to high temperatures (500°C) in the absence of oxygen. This breaks down the plastic into its constituent molecules, which can then be recovered and used to create new products.

Thermolysis plastic recycling has some limitations, including:

It requires specialized equipment. Thermolysis plastic recycling requires high-temperature reactors and other specialized equipment in order to convert the plastic into its constituent molecules. This can make it expensive and complex to set up and operate a thermolysis plastic recycling facility.

It can produce harmful byproducts. Thermolysis plastic recycling can produce byproducts, such as gasses and other pollutants if it is not carefully controlled. These byproducts can be harmful to the environment and human health if they are not properly managed.

It is not suitable for all types of plastic. Some types of plastic, such as PVC and PET, cannot be thermolyzed because they are difficult to break down into their constituent molecules.

Thermolysis requires a substantial heat input to raise the biomass to reaction temperature resulting in a large energy requirement. Additionally, the oil produced often requires extensive processing before it can be used in the same processes as crude oil.

Solvolysis (Solvent-based processes)

Solvolysis plastic recycling is a process in which waste or scrap plastic is dissolved in a solvent to break it down into its constituent molecules. The resulting solution can then be treated to recover the individual molecules, which can be used to create new products

Solvolysis plastic recycling has some limitations, including:

It requires specialized equipment. Solvolysis plastic recycling requires specialized reactors and other equipment in order to dissolve the plastic in a solvent and break it down into its constituent molecules. This can make it expensive and complex to set up and operate a solvolysis plastic recycling facility.

It can produce harmful byproducts. Solvolysis plastic recycling can produce byproducts, such as gasses and other pollutants if it is not carefully controlled. These byproducts can be harmful to the environment and human health if they are not properly managed.

It is not suitable for all types of plastic. Some types of plastic, such as PVC and PET, cannot be solvolyzed because they are difficult to dissolve in solvents.

Bitumen Upgrading Competing Technology

The following information is in the context of processing and transporting bitumen from Canada’s oil sands.

Upgraded Synthetic Crude Oil (SCO) Technique

Upgrading bitumen to synthetic crude oil involves several refining processes. The most common include coking, where bitumen is heated, breaking down the heavy molecules into lighter hydrocarbons and hydroprocessing, which uses hydrogen to remove sulfur and nitrogen impurities and crack larger hydrocarbon molecules.

The result is a lighter, less dense product that resembles conventional crude oil. Synthetic crude is more valuable and easier to transport and refine because it is closer to the quality of conventional crude oil.

Advantages

Quality of Product: Upgraded SCO is of higher quality, similar to conventional crude oil, which makes it more marketable and often fetches a higher price

Easier Refining: SCO is easier to process in conventional refineries due to its lower viscosity and reduced sulphur and heavy metal content.

Transportation Efficiency: SCO can be transported more efficiently through pipelines as it does not require diluents.

Environmental Consideration: Lower sulphur content means less intensive refining processes, potentially leading to lower greenhouse gas emissions during refining.

Disadvantages

High Capital Costs: Upgrading facilities are expensive to build and maintain

Operational Complexity: The upgrading process is complex and requires significant energy input

Market Dependency: The economics of upgrading can be sensitive to market conditions, particularly the price differential between heavy crude and lighter crude.

Diluted Bitumen Technique

This method involves blending the heavy bitumen with lighter hydrocarbons, typically natural gas condensates, naphtha, or a mix of other light hydrocarbons. This process reduces the viscosity and density of the bitumen, making it fluid enough to be transported through pipelines.

The diluted bitumen is not as high in quality as synthetic crude oil and requires more intensive refining to produce high-value products like gasoline and diesel. However, dilution is a less expensive process compared to upgrading.

Advantages

Lower Upfront Costs: Dilution is a simpler, less capital-intensive process compared to building and operating upgrading facilities.

Flexibility in Transport: Dilbit can be transported using existing pipeline infrastructure designed for conventional crude.

Adaptability: The dilution process can be easily scaled up or down based on market demand and pipeline capacity.

Disadvantages

Quality of Product: Dilbit is of lower quality compared to SCO, necessitating more complex refining processes that can be more costly and emit more greenhouse gasses.

Transportation Costs: The need to source and transport diluents adds additional costs and logistical complexity.

Pipeline Capacity: Dilbit is bulkier than SCO due to the added volume of diluents, potentially reducing the total capacity of pipelines.

Environmental Concerns: In case of leaks or spills, dilbit can be more challenging to manage and clean up due to its heavy nature and the presence of diluents.

Supportive research links

Disclaimer: I currently am a shareholder of Aduro and therefore have a vested interest in its success. I was not compensated in any form by the company to create this post.

My opinions are not investment recommendations and should not be relied upon for decisions. Information may be incomplete or subject to change. Investors should conduct their research and consult a qualified adviser.

Investments carry risks, and past performance does not guarantee future results. I am not liable for financial losses based on this material. This content is not an offer or solicitation to buy or sell securities. Readers should verify information independently before acting.